In the world of dividend growth investing, one well-covered large-cap Chemicals stock stands out as a solid holding. With an impressive track record of increasing its dividend for 40+ consecutive years, this stock is a high-performer, placing it in the top 10% of all dividend stocks. Future dividend hikes are also expected, which is a significant factor for long-term growth potential.

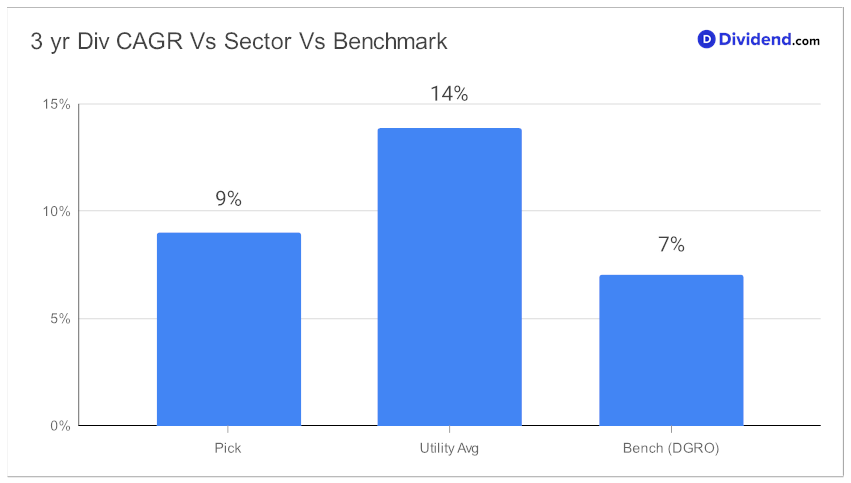

Speaking of growth, the stock boasts a 9% compound annual growth rate (CAGR) for dividends per share over the last three years. This ranks it in the top 40% among all dividend stocks, presenting a compelling case for its dividend growth reliability.

Additionally, since making it to this portfolio back in June 2023, the stock has managed to beat the benchmark by a small margin.

Next on the horizon for this stock is a qualified dividend payout of $1.750 per share. This dividend went ex-dividend on September 29 and is slated for a November 13 pay date. If you’re a dividend growth investor looking for an optimal blend of Returns Potential and Dividend Safety, this stock is an ideal fit.

The selection process also considers Returns Risk and Yield Attractiveness to a lesser extent, ensuring a balanced portfolio addition. Additionally, we’ve also taken into account the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on August 4, 2023.

For a deeper dive into why this stock deserves a spot in your dividend growth portfolio, stay tuned for our comprehensive stock analysis that follows.