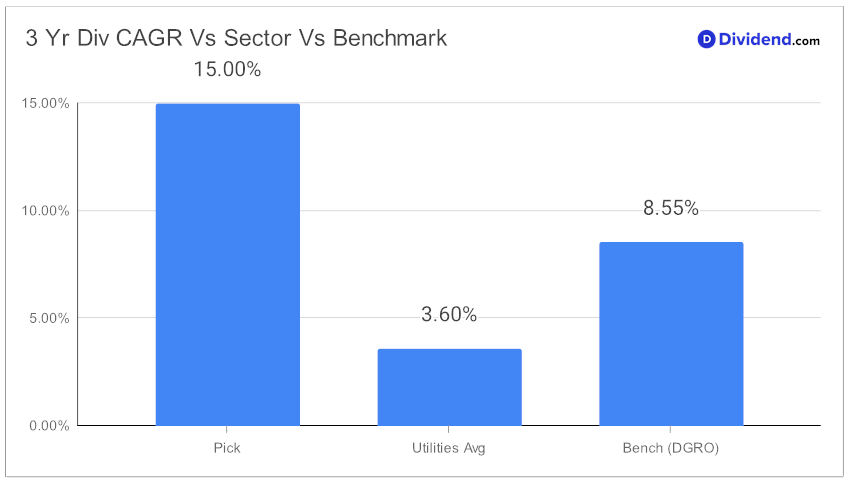

In the dynamic world of dividend investing, a certain large-cap Power Generation stock has recently emerged as a standout performer, captivating dividend growth investors with its impressive track record and future potential. In the last three years, this company has achieved a commendable 15% compound annual growth rate in dividends per share, placing it in the top 40% of all dividend stocks. This performance is not just in dividends; the stock has also outpaced the market, returning 66% year-to-date, significantly ahead of the S&P 500’s 25% and its industry’s 41%.

The next payout from this company is particularly noteworthy. Investors can anticipate a 3.4% increase in the qualified dividend, amounting to $0.213 per share. This increase went ex-dividend on December 19, with the payment date set for December 29, marking a lucrative opportunity for those focused on income generation.

Our comprehensive analysis delves deeper, evaluating the stock based on its potential for returns, dividend safety, and its relative attractiveness in terms of yield. While prioritizing return potential through dividend growth, we also consider the dimensions of returns risk and yield attractiveness. We’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 8, 2023.This balanced approach underpins our recommendation process, ensuring a well-rounded investment perspective.

Stay tuned for an in-depth analysis that unpacks the nuances of this investment opportunity.