In the quest for robust returns amid a sea of dividend contenders, our latest analysis reaffirms a certain mid-cap banking gem as a sterling pick for our Best Dividend Growth Stocks model portfolio. With a forward payout ratio sitting at a comfortable 28%—a figure that not only speaks to sustainability but also aligns with its industry’s average—it’s no wonder this stock has captured our attention.

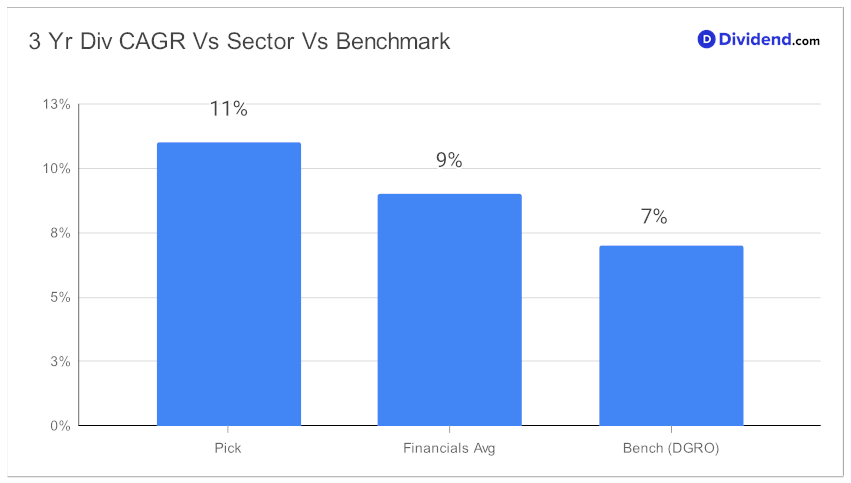

Diving deeper, we see a 3-year compound annual growth rate (CAGR) for dividends per share that ascends high into the top echelons, marking an 11% increase and besting a substantial fraction of its peers. While the year-to-date return lingers slightly in the negative, outpacing the banking sector at large suggests a resilience worth acknowledging.

As dividend growth investors, your gaze should be firmly fixed on the horizon, and that’s where the next payout looms—an estimated $0.550 per share by mid-November. This is a beacon for those optimizing their portfolios for dividend growth and safety.

Stay tuned for our in-depth analysis, where we peel back the layers of this stock’s potential and examine the intricate balance of returns risk and yield attractiveness that could bolster your investment journey. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 27, 2023.