In the dynamic world of investment, discerning dividend growth investors continually seek opportunities that balance growth potential with financial stability. One such opportunity arises from a well-covered mid-cap banking stock, which remains a steadfast component in a leading Dividend Growth Stocks model portfolio. This stock stands out with a forward payout ratio of just 23%, aligning closely with the banking sector’s average yet maintaining a commendable stance on dividend security and sustainability.

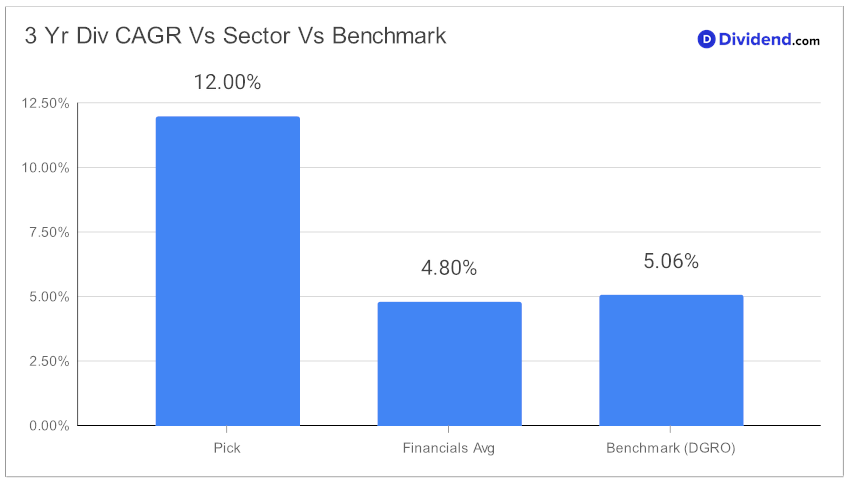

Over the past three years, the stock has demonstrated robust growth with a dividend compound annual growth rate (CAGR) of 12%, positioning it favorably within the top 40% of all dividend-paying stocks.

Despite the broader market’s volatility, it has posted a year-to-date return of 5%, closely shadowing its industry peers and outpacing many with its prudent financial management. Since making it to this portfolio back in September 2023, the stock has manged to consistantly outperform this portfolio’s benchmark.

Looking ahead, investors can anticipate the next dividend payout of an estimated $0.620 per share around May 10. This marks an excellent entry point for those focused on reliable income streams, and serves as a precursor to a deeper analysis that explores both the intrinsic qualities and potential risks associated with this investment.

While arriving at the recommendation we also factored in the 1Q24 earnings call discussion by the company management held on 24 Apr, 2024. The bank reported a stable first quarter in 2024 with a net income exceeding $100 million, adjusted to $135 million after accounting for specific non-recurring expenses. The bank noted an increase in net interest income (NII) influenced by higher loan balances and favorable repricing of loans and securities. Management discussed economic growth in the bank’s main operating region, reflecting positive trends in employment and tourism, which supports a favorable business environment.

Future projections include an anticipated 3% to 6% loan growth and a 9% to 13% increase in NII for the year. The bank’s strategy focuses on maintaining robust capital management and shareholder returns, emphasizing strong regulatory capital levels and sustainable profitability.

For those attuned to the nuances of dividend growth investing, this analysis promises to offer valuable insights into optimizing return potential while carefully assessing dividend safety and market risks.