If you’re a retirement dividend investor seeking to fortify your income stream, a well-covered large-cap equity Real Estate Investment Trust (eREIT) in our Best Dividend Protection Stocks model portfolio is worthy of your consideration. This stock offers a forward dividend yield of 4.83%, which ranks it in the top 40% of dividend stocks. While this yield is a tad lower than the eREIT industry average of 6.4%, the stock’s 14-year track record of dividend increases places it in the top 10% of dividend stocks. Moreover, future dividend increases are anticipated.

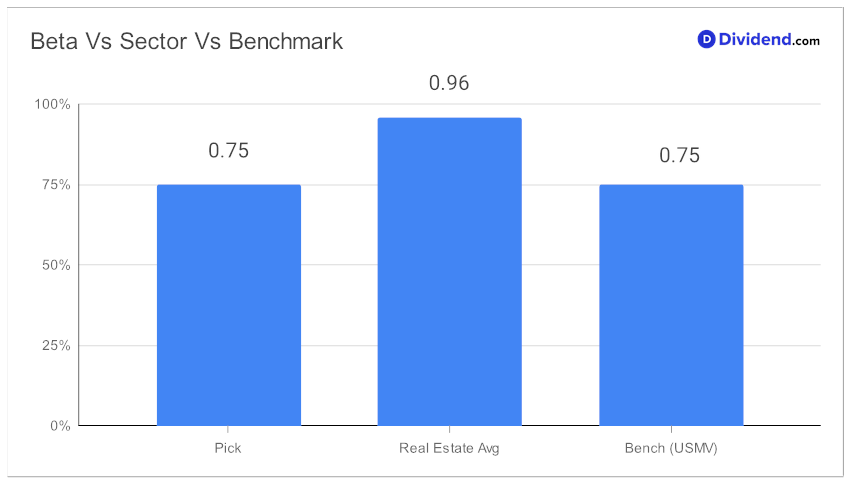

A unique attribute of this stock is its beta of 0.75. This means the stock’s monthly returns are not strongly correlated with broader equity markets, providing an excellent opportunity to diversify an equity-heavy portfolio.

The company is a well-run apartment REIT, with a diversified presence in the U.S. across more than 400 apartment buildings. But rising expenses and lower occupancy rates partially led to a 9% year-to-date share price decline versus the S&P 500’s 13% gain. To address that, the company aims to leverage its diversified portfolio of rental units at different price points. Additionally, its technological investments are aimed at innovation and cost management to improve margins.

For those eyeing immediate returns, the next payout is an unchanged non-qualified $0.420 per share, going ex-dividend this Friday, October 6.

For investors looking to optimize for Dividend Safety and Returns Risk, and to a lesser extent, Yield Attractiveness and Returns Potential, this stock fits the bill perfectly. We have also taken into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 28, 2023.

Stay tuned for our in-depth stock analysis that follows, illuminating how this eREIT can enhance your portfolio’s resilience and growth prospects.