For retirement dividend investors seeking robust, long-term dividend growth alongside competitive stock performance, look no further than this mega-cap semiconductor stock that has just been added to the Best Dividend Protection Stocks model portfolio.

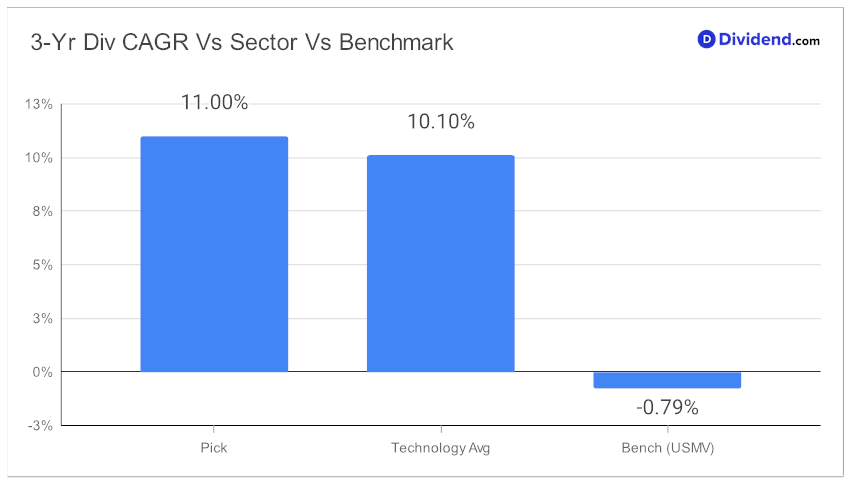

With an unparalleled 13-year dividend increase track record, this stock has consistently shown commitment to its dividend investors, placing it in the top 10% of all dividend stocks. Future dividend hikes are highly expected, strengthening its attractiveness as a stable income source. The stock boasts a 3-year dividend per share compound annual growth rate of 11%, placing it in the top 40% of all dividend stocks.

When it comes to returns, the stock has clearly outperformed the broader market. Year-to-date, the stock has provided an impressive 56% return, significantly outstripping the S&P 500’s 19% gain. In the semiconductor industry itself, which has returned 111%, this stock offers a compelling mix of relatively high returns and dividend safety.

Furthermore, for those keen on immediate cash flow, this stock is about to go ex-dividend on Wednesday, September 20, with an unchanged but well-covered payout of $4.600 per share.

We also take into account the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on September 1, 2023.

Our recommendation process focuses on optimizing for Dividend Safety and Returns Risk, while also considering Yield Attractiveness and Returns Potential to a lesser extent. For a comprehensive evaluation of why this stock could be a valuable addition to your portfolio, stay tuned for the in-depth analysis that follows.