In the ever-evolving world of retirement investments, dividend stocks remain a cornerstone for those seeking steady income and risk mitigation. A notable addition to the Best Dividend Protection Stocks model portfolio embodies these qualities, boasting an impressive profile that caters specifically to retirement dividend investors. This large-cap Integrated Utilities stock stands out with its forward dividend yield of 4.45%, surpassing the industry average of 4.3%. This yield is not only robust but also ranks in the top 40% of dividend stocks, making it an attractive option for investors.

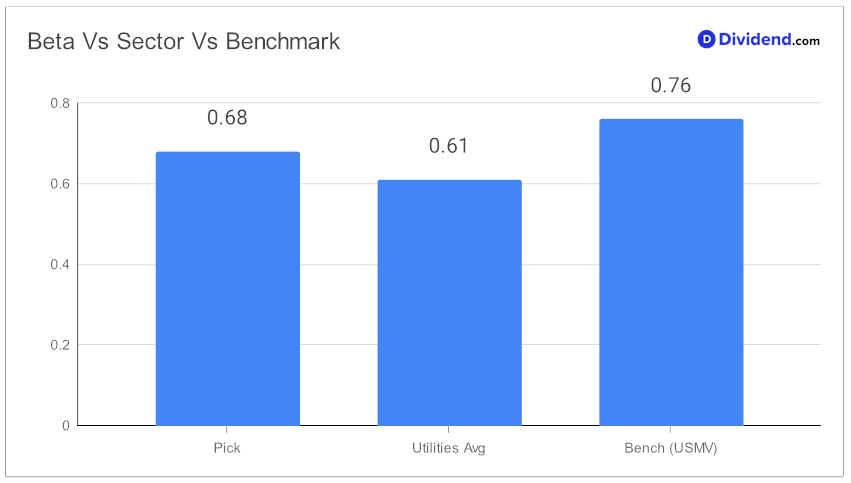

The stock further enhances its appeal with a commendable history of dividend increases, extending over nine years and ranking it in the top 30% for future growth prospects. Diversification is another key advantage, as evidenced by its low beta of 0.68, indicating minimal correlation with broader equity market movements. This feature is particularly beneficial for those looking to balance their equity portfolios with less volatile options.

Investors should take note of the upcoming payout—a qualified dividend of $1.130 per share, reflecting a 5.6% increase. This payout went ex-dividend on November 13 and is scheduled for payment on December 1. This imminent distribution is a testament to the stock’s commitment to rewarding shareholders and underlines its suitability for a retirement-focused portfolio.

The selection of this stock for the Best Dividend Protection Stocks model portfolio was meticulously executed, optimizing for dividend safety, return risks, yield attractiveness, and return potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 2, 2023.

The in-depth analysis that follows delves deeper into the nuances of this investment, offering a comprehensive view of why it stands as a compelling choice for retirement dividend investors.