In the competitive landscape of Oil/Gas/Coal stocks, a new addition to the Best Dividend Protection Stocks model portfolio stands out. With a forward dividend yield of 3.78%, ranking in the top 40%, this well-covered mega-cap asset offers a strong performance compared to the industry average yield of 4.7%.

A remarkable 37-year track record of dividend increases, ranking in the top 10%, speaks to a stable and promising future. Investors can look forward to the next payout, an unchanged qualified $1.510 per share, going ex-dividend on the upcoming Thursday, August 17.

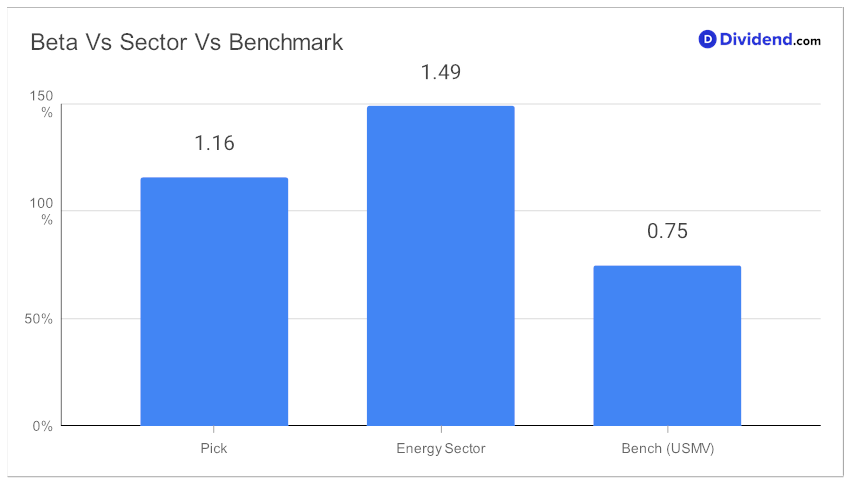

A market-like beta of 1.16, compared to the energy sector’s beta of 1.49, ensures the stock remains relatively less volatile compared to its peers.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q2 earnings call held on July 28, 2023.

The selection of this stock in the portfolio has been meticulously crafted to optimize for Dividend Safety and Returns Risk, considering to a lesser extent Yield Attractiveness and Returns Potential.

To understand the full potential of this investment, delve into the in-depth stock analysis that follows.