In the realm of retirement investing, securing a portfolio that withstands market volatility while offering consistent income is paramount. A well-covered mega-cap consumer products stock stands out in the model portfolio for Best Dividend Protection Stocks, underscoring the blend of reliability and performance that retirement dividend investors seek. This stock is celebrated for its remarkable 50+ year history of dividend increases, positioning it in the top echelon of dividend-paying entities. Such a track record not only signifies a strong commitment to shareholder returns but also suggests a robust financial foundation ensuring future growth.

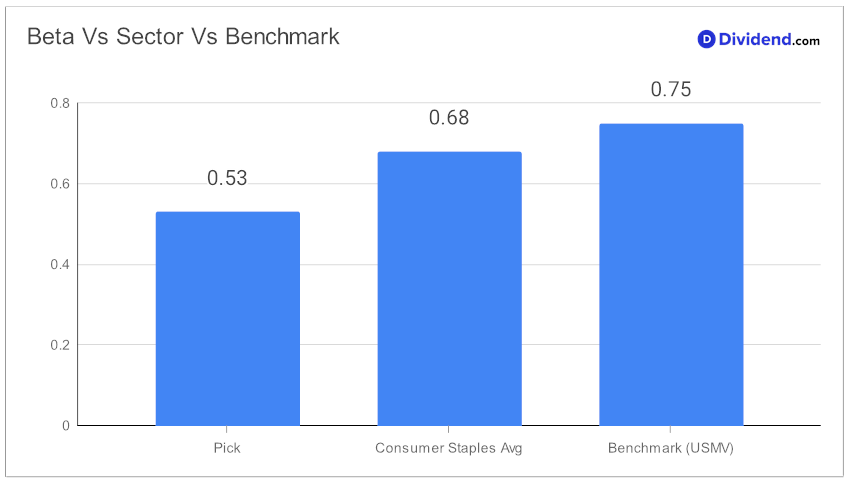

With a low beta of 0.53, this investment presents a unique opportunity to diversify and stabilize an equity portfolio, showcasing minimal correlation with broader market movements. This characteristic is especially appealing to those aiming to mitigate risk in their retirement savings.

Looking ahead, shareholders can anticipate a forthcoming payout estimated at $1.265 per share, slated for distribution on or around May 2. This next installment is a testament to the stock’s enduring appeal, combining dividend safety with attractive returns potential.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 09 Feb, 2024. The global food and beverage company reported a solid performance in 2023, with a 9.5 percent increase in organic revenue growth, albeit slightly lower than the previous year. The company, known for its diverse product portfolio, has seen significant contributions from its global convenient foods and beverages segments. Despite facing challenges such as moderated category growth rates, evolving consumer preferences, and international conflicts, it achieved substantial financial health improvements and continued investment in innovation and sustainability.

Looking ahead, the corporation anticipates at least 4 percent organic revenue growth and 8 percent core constant currency EPS growth for 2024, indicating cautious optimism amidst ongoing geopolitical tensions and inflationary pressures, emphasizing its commitment to strategic cost management and shareholder value.

The comprehensive analysis that follows delves deeper into the metrics and methodologies underpinning this recommendation, prioritizing dividend safety and returns risk, while also considering yield attractiveness and returns potential. This nuanced approach ensures that investors are well-informed, enabling them to make decisions that align with their retirement goals and risk tolerance.