Discover an exceptional opportunity for your retirement nest egg! This large-cap insurance stock is one of the gems in our Best Dividend Protection Stocks model portfolio, boasting a stellar 15+ year track record of dividend increases. This places it firmly within the top 10% of dividend stocks, and the expectation is for this trend to continue!

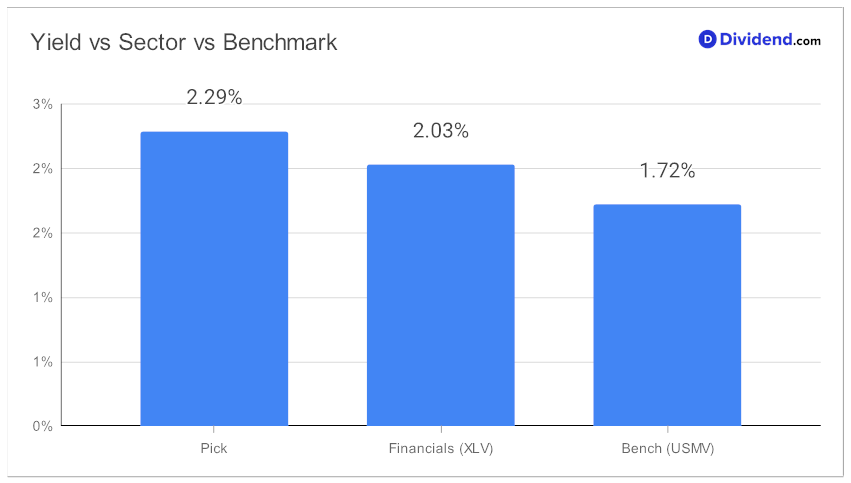

It features a prudently managed payout ratio of 27%, in line with the industry average of 34%, signifying a sustainable return potential. Additionally, it yields 2.29%, which is higher than that of financial sector average and this portfolio’s benchmark.

Importantly, its low beta of 0.61 implies that its monthly returns are not significantly influenced by wider equity market fluctuations, providing a perfect diversification opportunity.

Excitingly, this company has just announced another qualified payout of $1.00 per share, set to go ex-dividend on September 7.

While coming up with our final recommendation, we’ve factored in the stock’s 2Q 2023 earnings results announced on July 21, 2023.

These impressive factors, optimized for Dividend Safety and Returns Risk, make it a promising choice for retirement investors.

Stay tuned for an in-depth stock analysis to learn more!