In the ever-evolving landscape of investment opportunities, a particular stock continues to shine as a beacon of stability and growth for retirement dividend investors. Boasting an impressive 40+ year track record of dividend increases, this stock ranks in the top 10% of its peers, reflecting a steadfast commitment to shareholder value. The anticipation of future dividend growth further cements its position as a solid choice for those seeking reliable income streams.

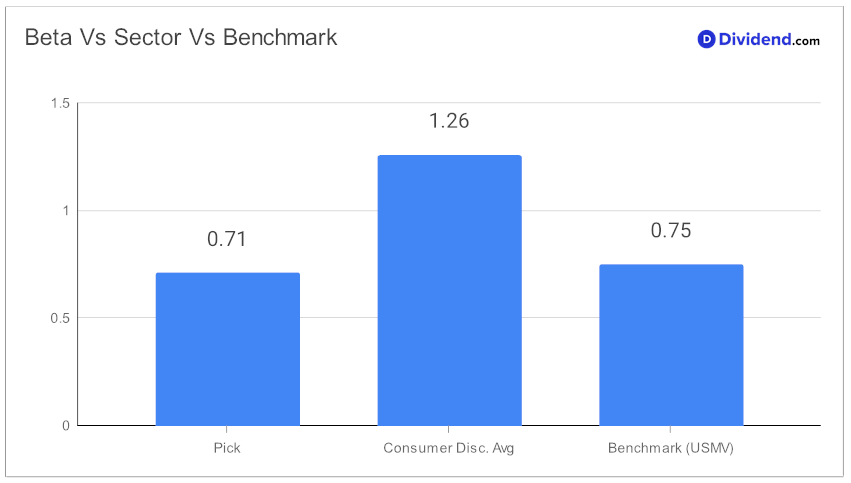

Remarkably, the stock’s three-year dividend per share compound annual growth rate (CAGR) of 8% places it in the formidable top 40% bracket of all dividend-yielding stocks. This trend showcases not only its current strength but also points towards a robust financial future. Furthermore, with a beta of 0.71, this stock presents a compelling case for portfolio diversification. Its monthly returns show a low correlation to broader equity markets, offering a cushion against market volatility.

Investors can look forward to the next payout, estimated at a generous $1.670 per share, around February 2nd. This forthcoming distribution is a testament to the stock’s ability to deliver consistent and attractive returns to its shareholders.

Delving deeper into this investment, an in-depth stock analysis reveals a strategic approach prioritizing dividend safety and returns risk, while also considering yield attractiveness and returns potential. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 31, 2023.

This meticulous selection process underscores the stock’s viability for those seeking a balanced blend of income and growth.