In the world of retirement investing, stability and reliability are key. Investors seeking to bolster their portfolios with dependable dividend-paying stocks need look no further than a notable large-cap Chemicals stock, renowned for its exceptional dividend track record. This company, a mainstay in the Best Dividend Protection Stocks model portfolio, stands out for its 48-year history of dividend increases. This impressive streak places it in the top 10% of dividend stocks, with expectations of future increases adding to its allure.

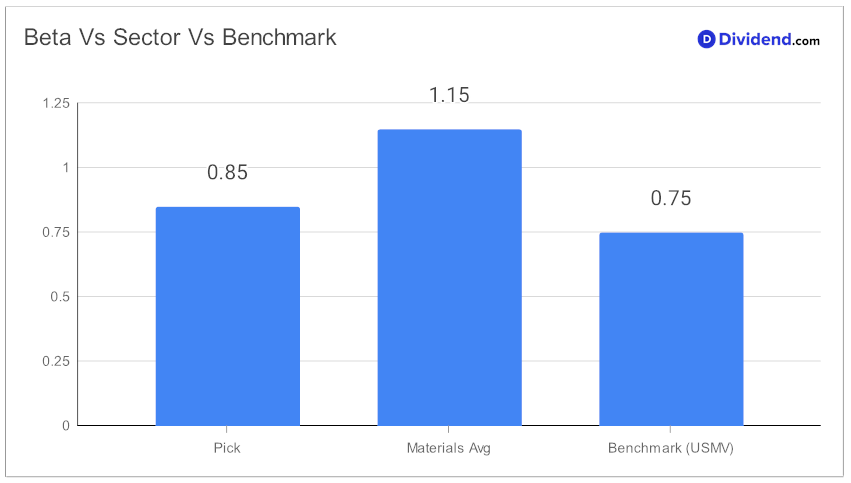

The stock features a beta of 0.85, highlighting slightly less volatility compared to the broader market. However, compared to its peers, the stock is relatively stable.

For those closely tracking dividend schedules, the next payout is set to be a steady $1.750 per share. Notably, this amount remained unchanged from the previous distribution, reflecting a consistency that is highly valued in the realm of dividend investing. This payout went ex-dividend on December 29, with the payment date scheduled for February 12.

What underscores the recommendation of this stock is not just its dividend history but also a comprehensive analysis process. Focusing on Dividend Safety and Returns Risk, with a secondary emphasis on Yield Attractiveness and Returns Potential, the selection process is thorough and well-rounded.While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on November 8, 2023.

The following analysis dives deeper into the specifics of this stock, offering insights into why it remains a top choice for those prioritizing dividend security and long-term growth potential in their retirement investments.