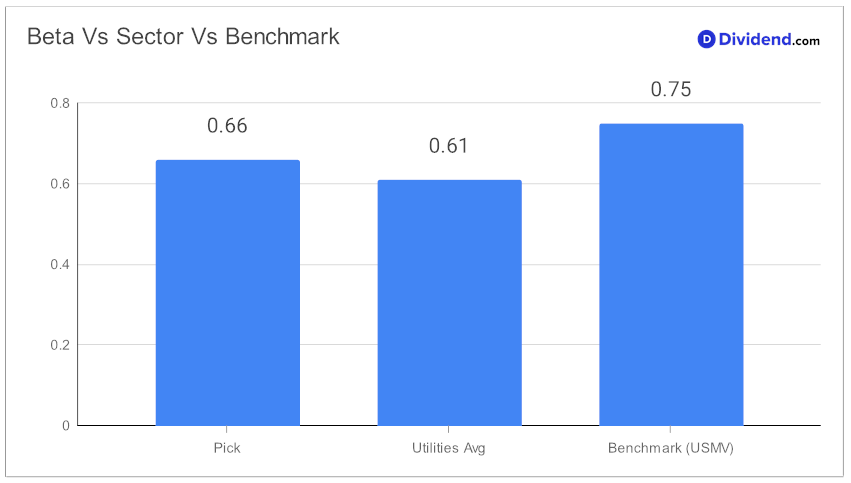

In the realm of retirement investing, where stability often trumps speculation, one large-cap Utility Networks stock stands out for its commendable blend of dividend reliability and growth potential. With a distinguished history of dividend increases stretching over four decades—a track record that places it in the elite top 10% of dividend stocks—this entity not only promises consistency but also hints at future growth with its 8% 3-year dividend per share compound annual growth rate. Notably, its 0.66 beta coefficient signals a low correlation with broader equity market movements, offering a diversifying buffer for investors’ equity portfolios.

As we edge closer to the next anticipated payout, estimated at $0.805 per share on or around May 3, investors have a tangible milestone to mark on their calendars. This upcoming dividend payment serves as a beacon of the stock’s commitment to shareholder returns, underpinned by a rigorous selection process that prioritizes dividend safety and minimizes returns risk, while still considering yield attractiveness and potential for returns.

While arriving at the recommendation we also factored in the 1Q24 earnings call discussion by the company management held on 08 Feb, 2024. The natural gas distribution, transmission, and storage company reported strong results, underpinned by strategic modernization efforts and significant customer growth, especially in Texas. The management highlighted the impact of a robust job market on customer expansion and detailed investments in system safety and reliability projects. Financial performance showed an 8.9% increase in earnings per share (EPS), with effective cost management contributing to reduced operations and maintenance expenses.

Future guidance remains optimistic, with EPS projected between $6.45 and $6.65 for fiscal 2024, reflecting confidence in operational efficiency and financial strategy. The company’s focus on regulatory outcomes and customer satisfaction underscores its commitment to sustainable growth and shareholder returns.

Our in-depth analysis dives deeper into what makes this stock a compelling component of any retirement-focused investment portfolio. By exploring its unique position within the utility sector and examining its performance metrics, we unravel the layers behind its standout dividend protection characteristics.