In a dynamic financial landscape, it’s vital to add steadfast investments to your portfolio, particularly if you’re a retirement dividend investor. One well-covered large-cap Utility Networks stock now included in the Best Dividend Protection Stocks model portfolio stands out.

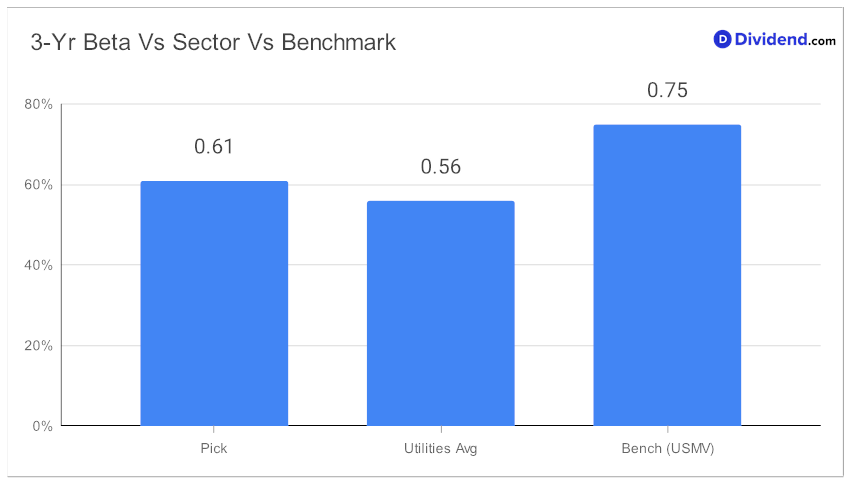

With an impressive 39-year dividend increase track record, ranking in the top 10% of dividend stocks, future growth in this area is expected. The relatively low beta of 0.61 indicates that monthly returns are not highly correlated with equity markets, offering a chance to diversify.

What’s more, the next payout remains unchanged at a qualified $0.740 per share, going ex-dividend on Friday (Aug 18).

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q3 earnings call held on Aug 3, 2023.

This stock aligns well with optimization for Dividend Safety and Returns Risk, and to a lesser extent, Yield Attractiveness and Returns Potential. Dive into our in-depth analysis that follows to understand how this can be a strategic part of your investment plan.