In the realm of retirement investing, stability and steady returns are paramount. Amidst the fluctuating markets, one particular large-cap eREIT stands out, not only for its impressive track record but also for its potential in safeguarding dividends for retirees. This eREIT has distinguished itself by consistently increasing its dividends over the past eight years, a feat placing it in the top echelon of dividend stocks. Such a record is not just a reflection of past performance but signals a promising outlook for future dividend growth.

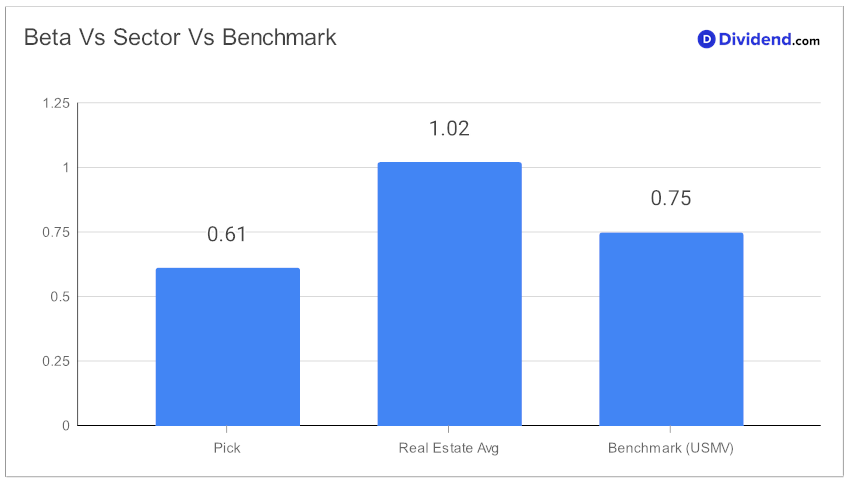

Further enhancing its appeal is the impressive 14% three-year compound annual growth rate in dividends per share, ranking it among the top 20% of all dividend stocks. What’s more, its low beta of 0.61 indicates a minimal correlation with the broader equity markets, offering a diversification benefit to an equity portfolio. This aspect is particularly crucial for retirement investors seeking to mitigate market volatility.

Year-to-date, this eREIT has delivered a 3% return, outperforming both the S&P 500 and the eREIT industry. The next payout, anticipated around February 15, is estimated at an attractive $4.260 per share. This upcoming distribution not only underlines the eREIT’s commitment to shareholders but also reaffirms its place in the ‘Best Dividend Protection Stocks’ model portfolio.

For those looking deeper, the following in-depth stock analysis unravels the layers behind this eREIT’s success. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 25, 2023.

It delves into how its dividend safety, return risks, yield attractiveness, and potential for returns are optimized, presenting a comprehensive view for the discerning retirement dividend investor.