In the realm of stable investments, there exists a titan among giants, a well-covered mega-cap in Consumer Products that stands out not only for its longevity but also for its consistency. With a dazzling 50+ year history of dividend increases—a performance that puts it in the elite decile of dividend stocks—this company has become a cornerstone for balanced investors seeking both yield and peace of mind. The anticipation of future hikes only adds to its luster.

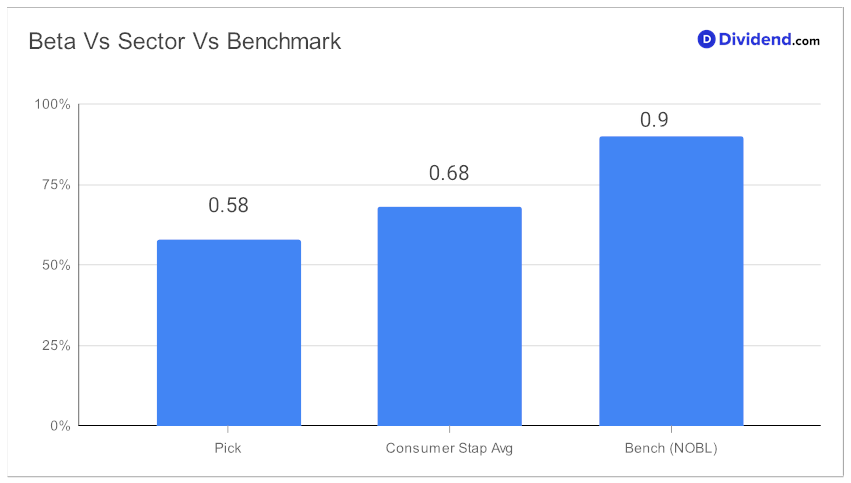

Savvy investors take note: the correlation of its monthly returns to the broader equity market is a muted affair, with a beta of 0.58 signaling a soothing diversification effect for your portfolio.

And for those marking their calendars, an attractive next payout looms on the horizon, with an estimated $1.265 per share expected to be dispensed on or around November 17.

Our rigorous recommendation process, diligently balancing Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk, underscores our confidence in this portfolio mainstay. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 10, 2023.

What follows is an in-depth stock analysis that will unveil the layered complexities and robust attributes of this venerable stock, promising a compelling case for its place in your investment strategy.