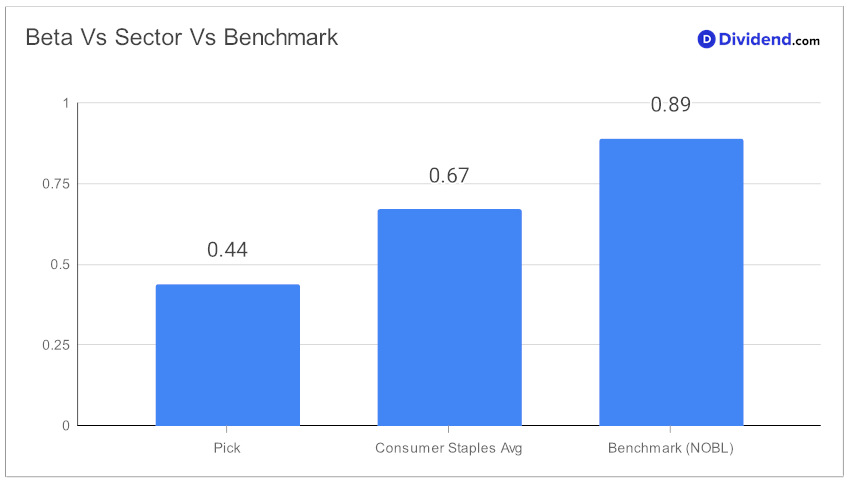

In the realm of dividend investing, the search for stability and growth often leads to a select few standout stocks that not only promise but deliver. Among these, a well-covered mega-cap Consumer Products stock has distinguished itself as a beacon of reliability and potential. With a commendable 60+ year track record of dividend increases—a testament to its financial health and commitment to shareholder value—this stock sits proudly in the top decile of dividend payers. Its unique position is further solidified by a low beta of 0.44, indicating a less direct correlation with the broader equity market fluctuations and offering a diversification benefit to investors’ portfolios.

This year, the stock has outperformed, delivering an 8% return compared to the S&P 500’s 5% and its industry’s 2%, showcasing its robustness amidst varying market conditions.

The upcoming payout remains steady at $0.941 per share, a reflection of its consistent shareholder rewards strategy. This payment, scheduled for tomorrow, February 15th, following a January 18th ex-dividend date, underscores the stock’s reliability and appeal to balanced dividend investors.

Our comprehensive analysis delves deeper into the metrics that make this stock a cornerstone of the Best Dividend Stocks model portfolio, optimizing for a harmonious blend of yield attractiveness, dividend safety, returns potential, and risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2024 earnings call held on January 25, 2024.

Join us as we uncover the facets of this investment opportunity, where stability meets growth, providing a foundation for those seeking to enhance their investment journey.