In the ever-evolving landscape of dividend investing, a standout utility networks stock has made its mark by being added to the prestigious Best Dividend Stocks model portfolio, signaling a noteworthy opportunity for balanced dividend investors. With a forward dividend yield of 4.07%, it not only surpasses the industry average of 3.6% but also positions itself in the top 40% of dividend-yielding stocks. This distinction speaks volumes, especially when coupled with a remarkable 13-year history of dividend increases, placing it in the elite top 10% of dividend stocks with expectations of future growth.

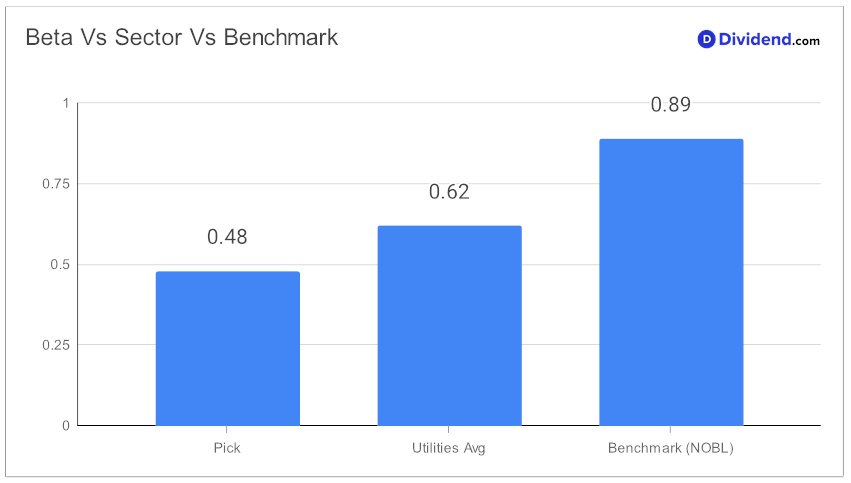

But it’s not just the yield that catches the eye. The stock exhibits a low beta of 0.48, illustrating minimal correlation with broader equity market movements. This characteristic offers a diversifying effect on an equity portfolio, appealing to investors seeking stability in turbulent times.

The upcoming payout, an estimated $0.265 per share on or around March 14, further underscores its appeal, providing a tangible near-term benefit for shareholders.

This inclusion is the result of a rigorous recommendation process that balances yield attractiveness, dividend safety, returns potential, and risk, ensuring only the most promising stocks make the cut. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 21, 2024.

The full analysis dives deeper, offering insights into why this stock represents a strategic addition to any investment portfolio seeking to balance risk and reward.