Discover the robust choice for balanced investors in the Best Dividend Stocks model portfolio: a leading large-cap Integrated Utilities contender.

This powerhouse boasts a remarkable 12-year history of dividend increases, placing it in the elite top 10% of dividend stocks, indicative of sustained financial health and promising future hikes. What’s more, its low beta of 0.64 is a beacon of stability, ensuring minimal correlation with broader equity market movements and serving as a bulwark against portfolio volatility.

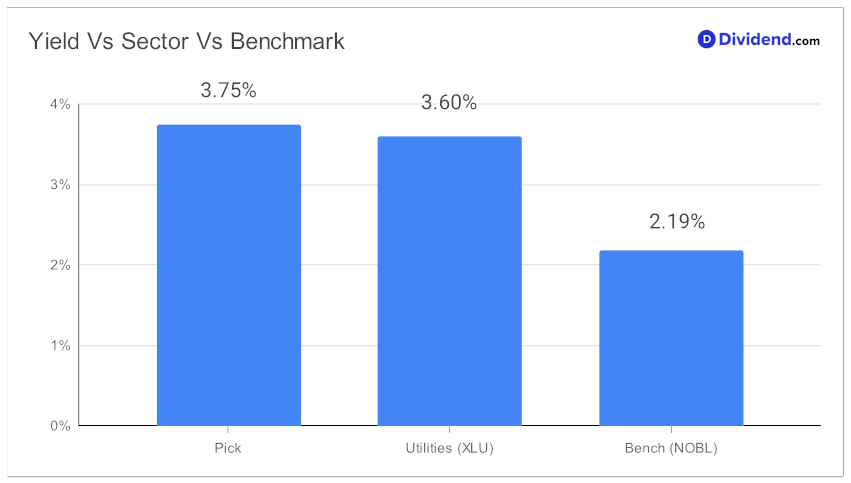

Imminent rewards are on the horizon with an anticipated dividend payout of $0.570 per share slated for mid-November, a testament to its lucrative positioning. The stock currently yields 3.75%, higher than the utility sector and this portfolio’s benchmark.

Delve deeper into the comprehensive analysis that follows, unlocking critical insights into the stock’s underlying strengths and strategic maneuvers. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 2, 2023.

This exploration is crucial for investors seeking to optimize for a perfect blend of attractive yields, dividend safety, and balanced return metrics.