In the ever-evolving landscape of the stock market, finding a blend of stability and growth in your investment portfolio is key. One standout large-cap Integrated Utilities stock is making waves among dividend investors, thanks to its robust financial health and promising returns. With a forward dividend yield of 3.70%, this stock not only outperforms the industry average but also offers a comforting sign of stability in uncertain times. Its impressive 13-year track record of dividend increases places it in the upper echelon of dividend stocks, signaling reliability and a commitment to shareholder returns.

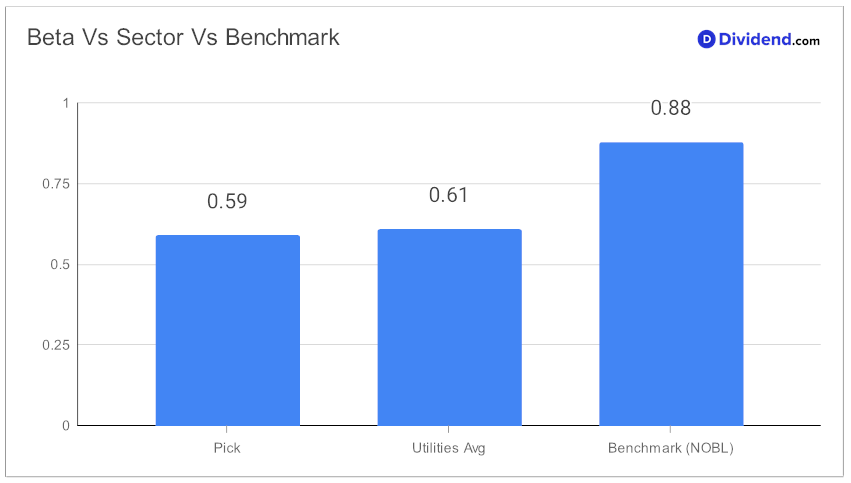

Furthermore, its low beta of 0.59 indicates a lower correlation with the volatile equity markets, providing a diversification advantage to investors.

Year-to-date, it has shown a commendable performance with a 6% return, outshining both the S&P 500 and its industry counterparts. Notably, shareholders can look forward to a 5.3% increase in the next qualified dividend payout of $0.600 per share, reinforcing the stock’s attractiveness.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 28, 2024. The utility company reported mixed financial results for the fourth quarter and full year of 2023, with a significant annual increase in net income per share despite a quarterly decrease.

The company’s 2024 outlook includes non-GAAP operating earnings guidance of $3.60 to $3.70 per share, with an expected 5% to 7% earnings Compound Annual Growth Rate (CAGR) through 2028. This outlook is supported by a robust $18 billion to $21 billion capital expenditure plan focused on regulated investments to enhance infrastructure and clean energy initiatives. The company’s strategic investments and regulatory advancements underscore its commitment to operational excellence and growth in the evolving utilities sector.

This analysis is just the tip of the iceberg. An in-depth examination reveals a meticulously balanced approach to evaluating yield attractiveness, dividend safety, and return potentials, making it a compelling consideration for balanced dividend investors seeking to optimize their portfolios.