In the ever-evolving landscape of dividend investing, a certain mid-cap eREIT stands out for its robust financial health and commendable track record.

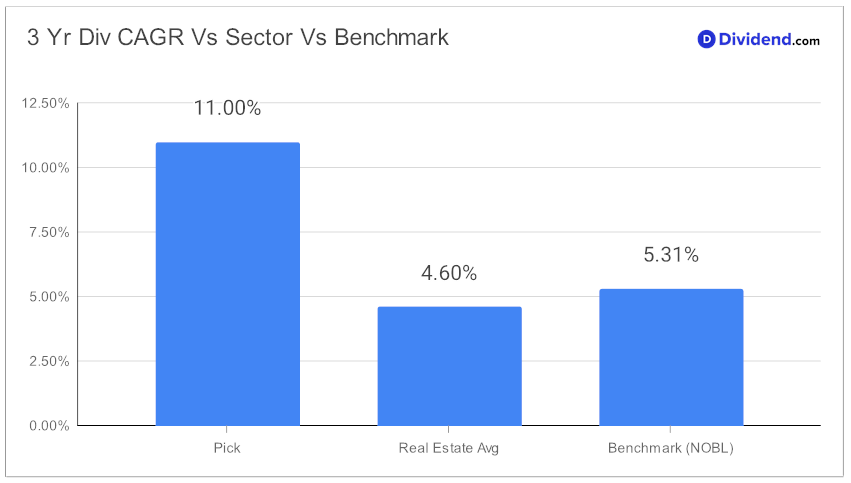

Notably, this entity has distinguished itself with an 11-year history of consistent dividend increases, positioning it in the prestigious top 10% echelon among its peers. The anticipation of future dividend growth further solidifies its appeal to investors seeking stability and growth. Impressively, its three-year dividend compound annual growth rate (CAGR) of 11% ranks well within the top 40%, highlighting its competitive edge in income generation.

Investors will find the next payout particularly attractive: a significant 15.6% increase to a non-qualified dividend of $0.370 per share, with the ex-dividend date set for March 27. This move not only reflects the company’s financial strength but also its commitment to rewarding shareholders generously.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on February 9, 2024. The industrial REIT reported a record year in 2023, with significant growth in cash rental rates and strategic transactions bolstering its outlook for 2024. Despite market challenges, the company achieved remarkable operational results, including noteworthy leasing achievements and strategic acquisitions in key markets.

The financial outlook remains optimistic, with projections indicating continued growth in funds from operations (FFO) and net operating income (NOI), driven by higher rental rates and strategic portfolio management. The company’s strong capital position, with no debt maturities until 2026 and planned asset sales, further positions it well for sustained growth and investment in future developments.

Our model portfolio selection process, meticulously crafted to balance yield attractiveness with dividend safety, potential returns, and risk, has identified this eREIT as a compelling addition. By delving deeper into our analysis, investors can uncover the nuances of this investment opportunity, ensuring a well-informed decision-making process that aligns with both growth aspirations and risk tolerance.