In the dynamic landscape of asset management stocks, a large-cap contender stands out for its solid performance and dividend reliability. This stock, a well-covered player in the asset management sector, has recently been reaffirmed as a holding in the prestigious Best Dividend Stocks model portfolio. The company continues to use its brand name and distribution scale to grow its portfolio of mutual funds and ETFs in trending categories, including cryptocurrency.

A key highlight is its 45% forward payout ratio, aligning closely with the industry average and underscoring its prudent financial management.

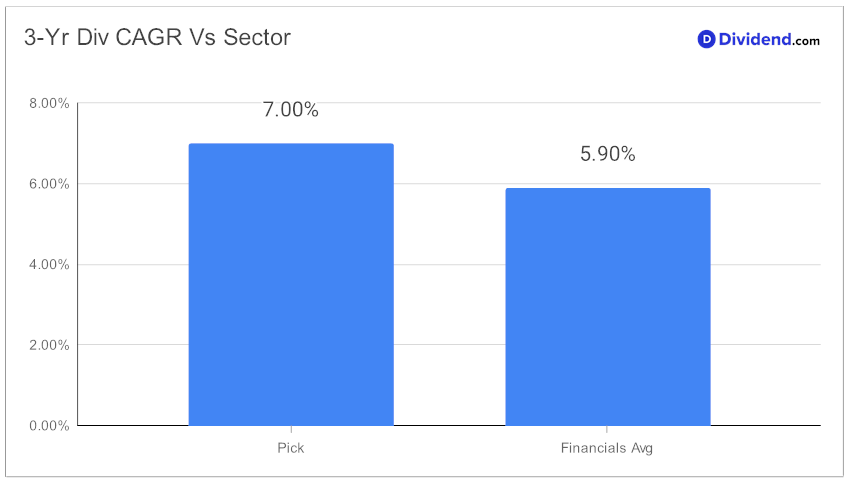

Investors seeking long-term stability will be heartened by the stock’s 15-year track record of consistent dividend increases, positioning it in the top 10% of dividend stocks. This remarkable consistency signals a strong likelihood of future increases, a crucial consideration for balanced dividend investors. Further adding to its appeal is its 7% three-year dividend compound annual growth rate (CAGR), ranking it in the top 40% of all dividend stocks.

The next payout, a testament to its growing dividend trend, is a 2.0% increased qualified $5.100 per share, going ex-dividend on March 6. This upcoming distribution reflects not only the stock’s commitment to shareholder returns but also its robust financial health.

This insightful article delves deeper into the stock’s performance, examining its place within the broader market and the methodology behind its recommendation. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 16, 2024.

The analysis optimizes for an equal blend of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk, offering a comprehensive view for investors. The in-depth analysis to follow will provide valuable insights, connecting the dots between this stock’s dividend performance and its overall investment potential.