Investors seeking a stable addition to their portfolio may find interest in a well-covered large-cap Consumer Discretionary Retail stock that has recently been added to the Best Dividend Stocks model portfolio.

With a forward payout ratio of 40%, aligning closely with the Consumer Discretionary Retail average of 32%, this holding offers security in a balanced dividend strategy.

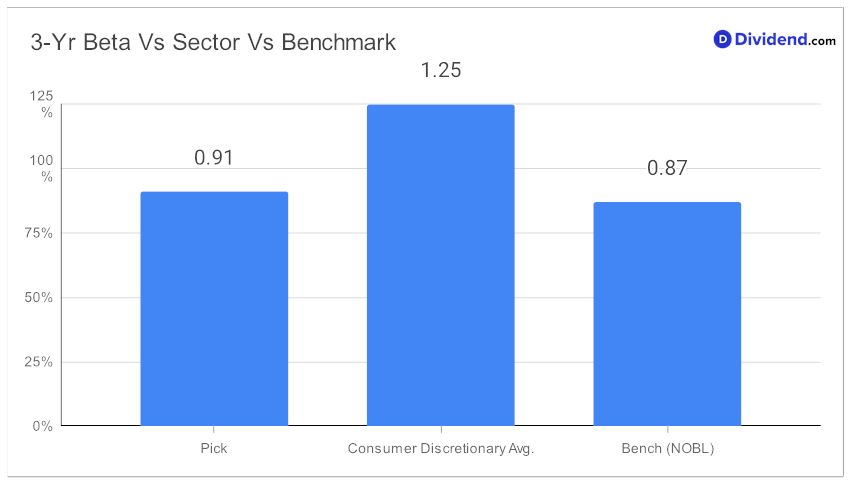

Its remarkable 60+ year dividend increase track record, ranking in the top 10% of dividend stocks, signifies consistent growth. The 0.91 beta indicates that monthly returns are not correlated to equity markets, thus providing an opportunity to diversify.

Investors can expect the next payout of an estimated $0.950 per share on or around August 15.

While forming our recommendation, we’ve also factored in key growth drivers and financial performance discussed by the company’s management during its Q2 earnings call held on July 21, 2023.

This selection was based on optimizing for an equal blend of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk. For more insights into this promising stock, an in-depth analysis follows.