When looking for a dividend stock that checks all the boxes—yield, safety, potential returns, and risk management—you’d be hard-pressed to find a better candidate that has just been reaffirmed as a holding in our Best Dividend Stocks model portfolio. With an unparalleled 60+ year track record of increasing dividends, this stock is a shining star in the top 10% of dividend-paying stocks, making it an exceptional pick for those focused on long-term income generation. Additionally, the expectation for future dividend increases only adds to its allure.

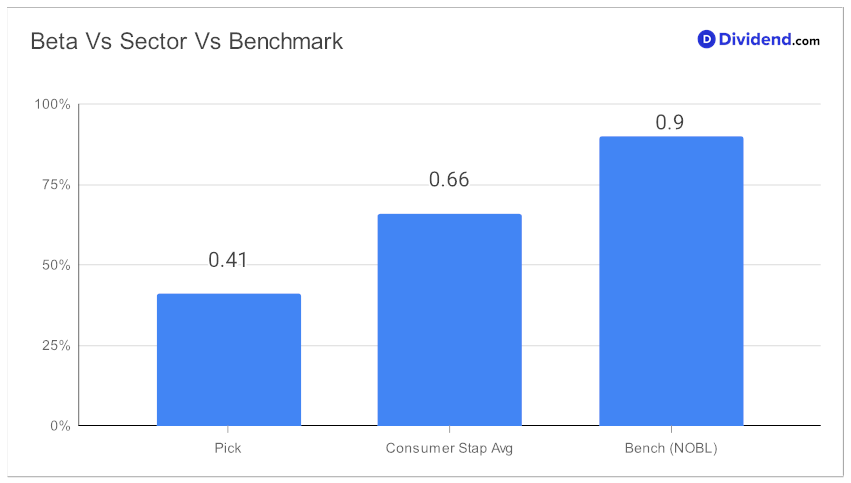

As balanced dividend investors, it’s critical to diversify and manage risk. With a low beta of 0.41, this stock promises to be a steady performer, minimally affected by broader market volatility. This characteristic allows you to add a layer of stability to your equity portfolio, effectively spreading risk.

What adds more excitement is the imminent dividend payout. Shareholders can expect an estimated payout of $0.941 per share on or around October 11. This represents a significant near-term income opportunity, not to be missed.

The stock has also outperformed this portfolio’s benchmark since making it to the list back in July 2022.

We also take into account the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on July 28, 2023.

Stay tuned for the in-depth analysis that follows, where we unpack each component of our recommendation process, focusing on an equal blend of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk.

This is the dividend stock you’ll want to know more about.