Dive into our in-depth analysis on an outstanding player in the Biotech/Pharma space, confidently maintaining its position in our Best Dividend Stocks model portfolio.

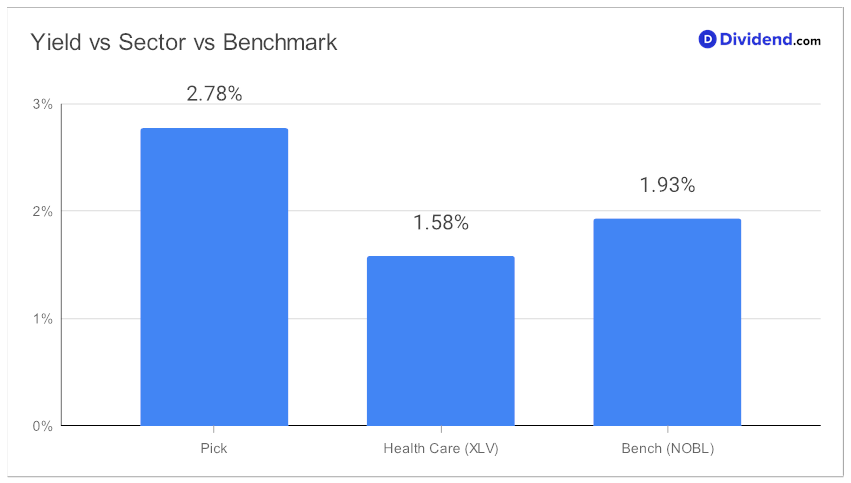

This is a stock with a remarkable 62-year track record of dividend increases, placing it in the top 10% of dividend stocks with future increases anticipated. Boasting a forward payout ratio of 43%, it aligns perfectly with the industry average of 39%, reflecting a financially healthy and sustainable payout. Additionally, the stock yields 2.78%, higher than the healthcare sector average and this portfolio’s benchmark.

Meanwhile, a 0.54 beta underlines its uncorrelated monthly returns, offering a diversified addition to your equity portfolio. What’s more, stay tuned for the next payout – a solid, unchanged $1.190 per share, declared recently and set to go ex-dividend on August 25.

With the stock reporting its 2Q 2023 earnings on July 23, 2023, we’ve diligently crafted our recommendation, balancing Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk.

Don’t miss out on this well-covered mega-cap gem in the following analysis.