Introducing a new addition to our Best Dividend Stocks model portfolio, a well-covered large-cap Asset Management stock that has consistently demonstrated its commitment to rewarding shareholders. This stock boasts a 10+ year dividend increase track record, placing it in the top 10% of all dividend stocks. Future increases are anticipated, making it an attractive option for balanced dividend investors.

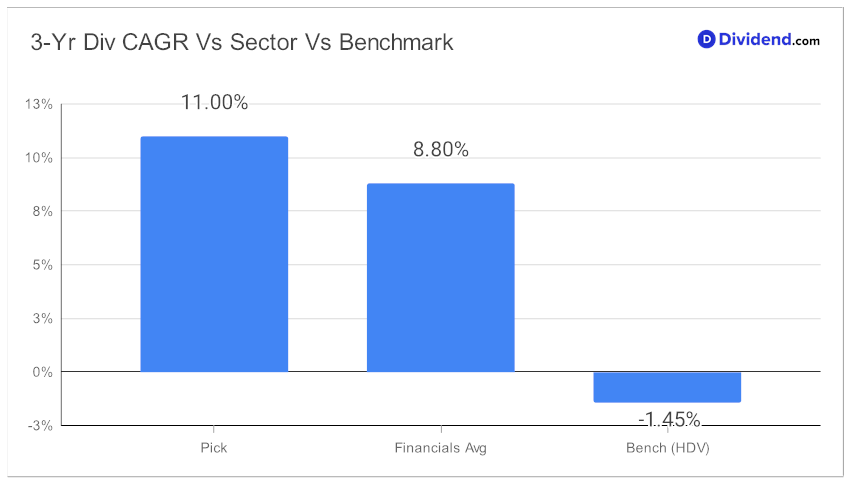

Over the past three years, this stock has shown an impressive 11% dividend per share compound annual growth rate, ranking it in the top 40% of all dividend stocks. This strong performance is a testament to the company’s robust financial health and its ability to generate sustainable returns.

The next payout is an unchanged qualified $5.000 per share, going ex-dividend tomorrow (Sep 7). This is a golden opportunity for investors to benefit from the company’s consistent dividend policy.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on July 15, 2023.

Our recommendation process optimizes for an equal blend of Yield Attractiveness, Dividend Safety, Returns Potential, and Returns Risk.

Stay tuned for an in-depth stock analysis that will provide a comprehensive overview of this promising addition to our portfolio.