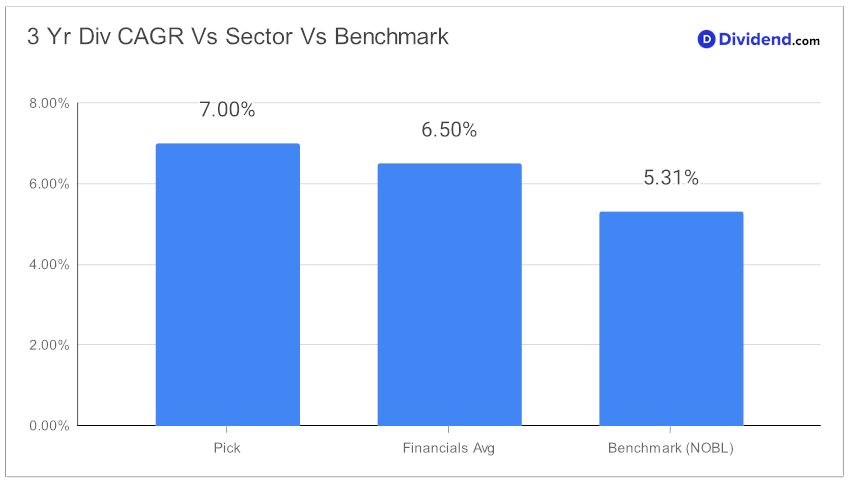

In the world of dividend investing, the discerning eye is always on the lookout for opportunities that blend yield attractiveness with safety and potential for returns. A notable addition to a model portfolio of top dividend stocks marks a moment of interest for balanced investors. This large-cap banking stock stands out with a forward dividend yield of 3.86%, surpassing the industry average and placing it commendably in the upper echelon of dividend payers. With a judicious payout ratio of 40%, it aligns closely with sector standards, promising sustainability. Additionally, the stock features a 3-year dividend growth of 7%, marginally better than its peer group and this portfolio benchmark.

What sets this entity apart is not just its competitive yield but a remarkable history of dividend growth, boasting a 10+ year streak of increases. Such a record not only signifies reliability but also signals the potential for future growth, making it a compelling consideration for those looking to fortify their portfolios against the vagaries of the market.

Despite a modest year-to-date return compared to broader indices, this stock represents a strategic blend of yield and growth prospects. The stock goes ex-dividend on March 27 with an unchanged regular payout of $0.35/ share, with a pay date of April 15.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 23 Jan, 2024. The regional bank reported a standout year with record revenue and deposit growth, outperforming industry averages amidst a challenging economic climate. The bank’s strategic investments and disciplined expense management led to top-quartile profitability and robust credit performance. Management highlighted a solid foundation for stability, profitability, and growth, despite anticipating adjustments due to regulatory changes and potential interest rate fluctuations.

The bank projects continued deposit growth and plans for shareholder returns, including share repurchases, in the latter half of the upcoming year. This outlook reflects a strategic focus on maintaining financial health and operational efficiency, positioning well for future economic scenarios and ensuring continued value for investors.

This introduction serves as a gateway to a deeper analysis that will explore the nuanced balance of risk and reward, aiming to provide investors with the insights needed to navigate the complexities of dividend investing with confidence.