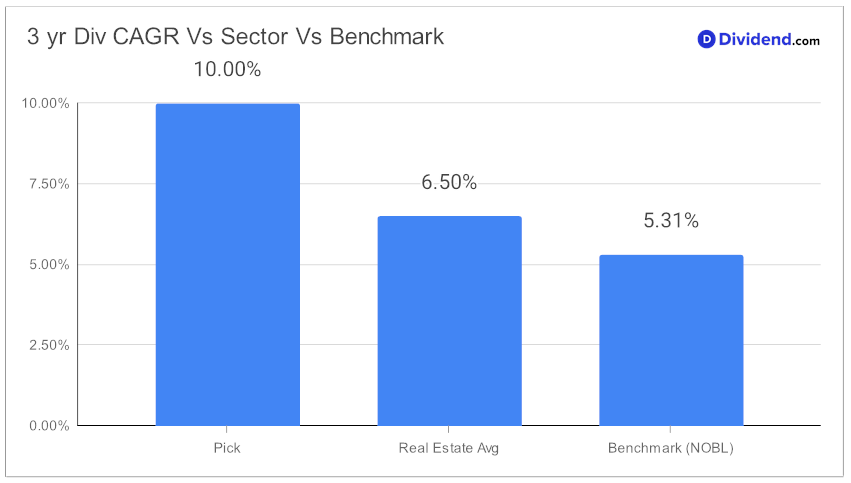

In the realm of balanced dividend investing, discerning investors often seek opportunities that not only promise attractive yields but also exhibit a robust track record of dividend growth and safety. One such opportunity has recently emerged, drawing attention for its commendable forward dividend yield of 5.30%, which not only surpasses the expectations for high yield investments but also aligns closely with the industry average. This investment stands out in the competitive landscape with a sterling history of dividend increases spanning more than 30 years, indicating a reliable income stream for shareholders. Furthermore, its 10% three-year dividend per share compound annual growth rate places it among the top performers, highlighting its potential for future growth.

As investors anticipate the next payout estimated at $0.565 per share on or around April 12, the blend of yield attractiveness, dividend safety, and the balance between returns potential and risk makes this option a noteworthy consideration.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 09 Feb, 2024. The REIT specializing in freestanding, single-tenant properties reported a strong performance, with significant growth in core funds from operations (FFO) and a strategic focus on acquisitions exceeding $800 million. The company maintained an impressive occupancy rate of 99.5%, reflecting operational excellence and efficient portfolio optimization. Management highlighted the minimal impact of a major tenant’s bankruptcy thanks to a disciplined investment approach, even amidst competitive pressures and economic uncertainties.

Looking ahead, the REIT plans to leverage free cash flow and asset dispositions to fund future growth without additional equity, emphasizing a cautious approach to access capital markets in the current economic environment.

This analysis provides a glimpse into the comprehensive evaluation process, optimizing for a harmonious mix of these crucial factors, and paves the way for an in-depth stock analysis that follows. This exploration not only serves as a guide for balanced dividend investors but also emphasizes the importance of due diligence and strategic portfolio diversification in achieving investment objectives.