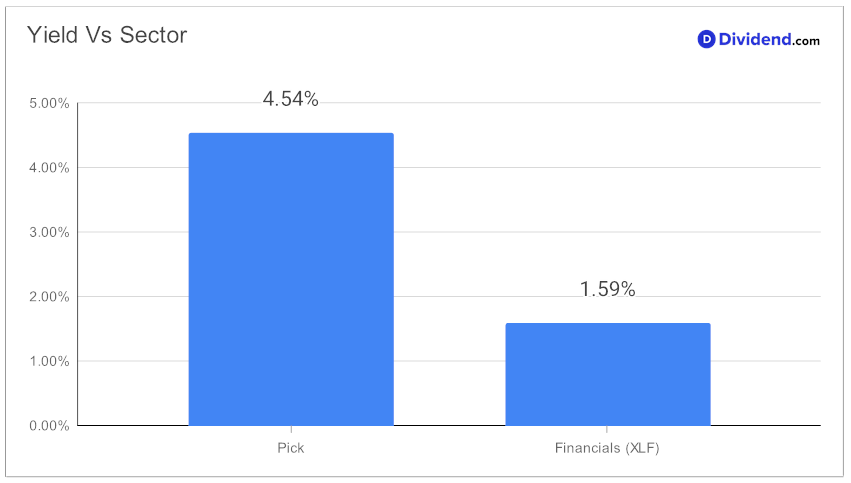

In the ever-evolving landscape of dividend investing, a noteworthy addition has made its way into the prestigious Best Sector Dividend Stocks model portfolio. This inclusion marks a significant step for balanced dividend investors seeking robust, well-covered opportunities within the financial sector. Characterized as a large-cap banking stock, this entity stands out with a forward dividend yield of 4.54%, surpassing the banking industry average of 3.8%. Such a yield not only places it in the top echelon of dividend stocks but also signals a compelling choice for those prioritizing income and stability.

Moreover, its impressive 13-year track record of dividend increases cements its position as a reliable source of growing income, projecting confidence in future payouts. The anticipation builds around its next estimated dividend payout of $0.490 per share, expected on or around March 14, highlighting an immediate benefit for shareholders.

While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q4 2023 earnings call held on January 18, 2024. The regional banking specialist reported a robust financial performance in the latest quarter, with significant earnings per share (EPS) adjustments leading to record annual net revenue. Management highlighted the strategic balance between fee-based business strengths and net interest income (NII) pressures, amidst a backdrop of slowing loan demand, particularly in corporate lending. The company also faced competitive deposit pricing challenges but maintained a strong liquidity profile.

Future outlook projections include a steady or slight increase in NII for the upcoming year, driven by new account growth and robust market activity. The company emphasized strategic investments and a focus on leveraging opportunities for growth, while closely monitoring credit quality and maintaining a solid capital position.

This addition is the result of a meticulous recommendation process focusing on an equal blend of yield, dividend safety, returns potential, and risk, exclusively among financials dividend stocks. The following in-depth analysis will unravel the layers behind this strategic choice, providing investors with a deeper understanding of its potential impact on their portfolios.