In the realm of Health Care dividend stocks, a certain large-cap Medical Devices stock is making a compelling case for balanced dividend investors. This stock stands out with a remarkable 40+ year track record of dividend increases, placing it in the top echelon of dividend stocks. Notably, this streak is not just a historical footnote; there’s an anticipated continuity of this trend, promising future increases.

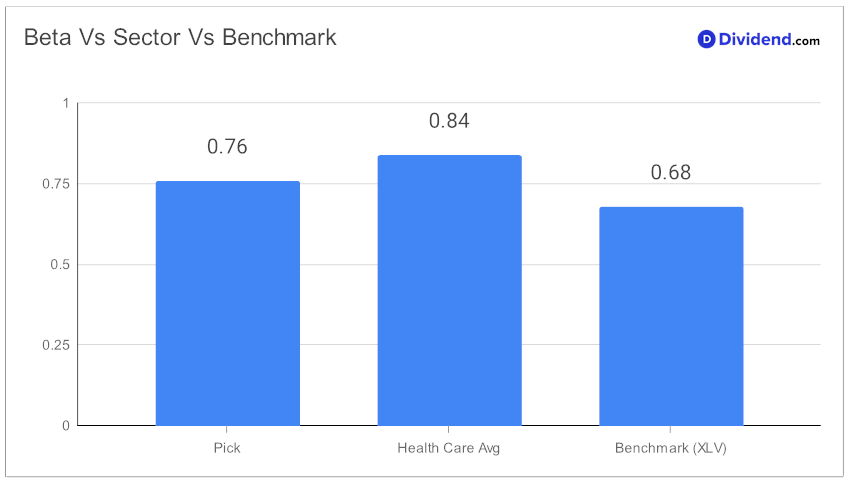

Diving into the specifics, the stock exhibits a 0.76 beta, indicating a low correlation with equity market fluctuations. This characteristic is particularly appealing for investors seeking to diversify their equity portfolios.

Since making it to this portfolio back in December 2023, this pick has comfortably beaten the portfolio benchmark by a healthy margin.

Investors have an upcoming opportunity with the next payout estimated at $0.690 per share, slated for distribution around March 1. This payout is a critical component in the stock’s attractiveness, balancing the scales between yield, dividend safety, returns potential, and risk.

The full analysis that follows delves deeper into this stock, unraveling its nuances and positioning within the Health Care sector. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q2 2024 earnings call held on November 21, 2023.

For investors seeking a balanced approach in their portfolio, this in-depth examination will provide valuable insights into why this stock is a noteworthy consideration in the Best Sector Dividend Stocks model portfolio.