Investors seeking stable and promising returns in the healthcare sector will be intrigued by the latest addition to the Best Sector Dividend Stocks model portfolio. This well-established, large-cap Health Care Facilities & Services stock stands out with its robust financial credentials. Boasting a modest yet reliable 18% forward payout ratio, it aligns closely with the sector’s average of 21%. Remarkably, its 3-year Dividend Compound Annual Growth Rate (CAGR) of 397% positions it in the top echelon of all dividend stocks, a testament to its growth and reliability.

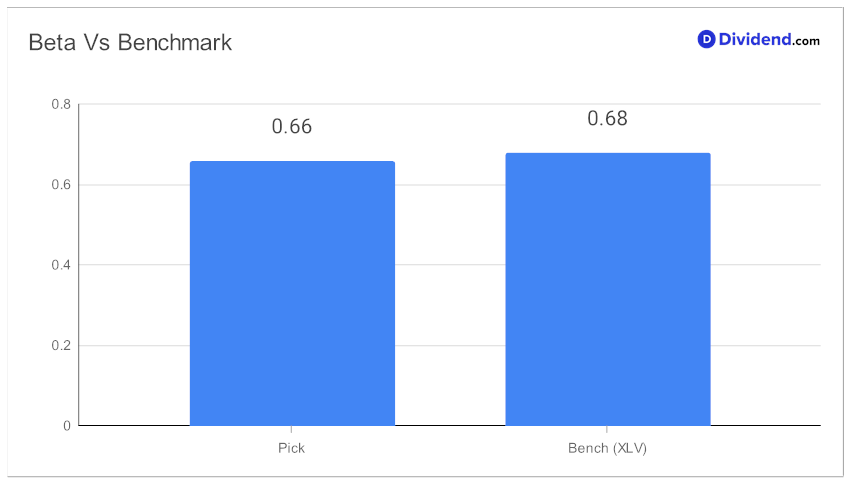

What sets this stock apart is its low beta of 0.66, indicating that its monthly returns are less influenced by broader market fluctuations. This characteristic enhances its appeal as a diversification tool within an equity portfolio. Furthermore, dividend investors can look forward to an upcoming payout of an unchanged $1.230 per share, with the ex-dividend date set for December 5th.

This addition to the model portfolio follows a rigorous recommendation process, optimizing for a balanced mix of yield, dividend safety, returns potential, and risk, specifically within the healthcare dividend stock category.

The in-depth analysis to follow will delve deeper into the stock’s prospects, providing a comprehensive overview for balanced dividend investors. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 4, 2023.

Stay tuned for a detailed exploration of this promising healthcare dividend stock, a potentially valuable addition to your investment portfolio.