Introducing a new addition to our Best Sector Dividend Stocks model portfolio—a well-covered large-cap Medical Devices stock. With an outstanding 47-year dividend increase track record, this company ranks among the top 10% of dividend-paying stocks. It’s a reliable choice for those who are focused on dividend sustainability, as it not only has a remarkable past, but future increases are also anticipated.

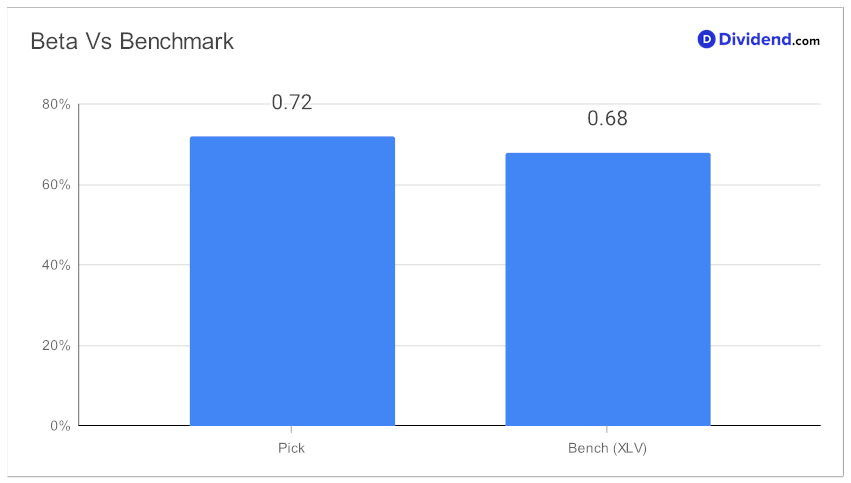

When it comes to risk profile, the stock comes with a 0.72 beta. This suggests that the stock’s monthly returns have a low correlation to broader equity markets, offering a unique opportunity to diversify your portfolio.

Thanks to the easing of supply chain woes, some new product launches, and an increase in the pace of medical procedures, the company has seen improving margins. Accordingly, the stock returned 5% YTD, in contrast with the S&P 500’s 17% and the Medical Devices industry’s -1%.

The stock just went ex-dividend today (September 21) with an unchanged payout of $0.69 per share.

We also take into account the growth drivers and financial results discussed by the company management during their Q1 2024 earnings call held on August 23, 2023.

Our recommendation process aims to achieve a balanced blend of yield, dividend safety, returns potential, and risk, strictly focusing on Health Care dividend stocks. Intrigued?

Stay tuned for our in-depth stock analysis that follows, for a deeper dive into why this Medical Devices stock could be a great addition to your portfolio.