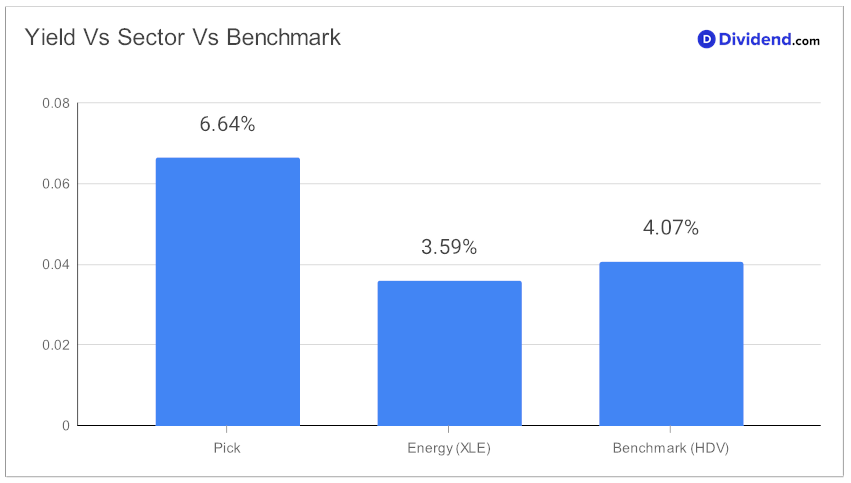

Are you on the lookout for a robust addition to your high dividend stock portfolio? Consider a standout in the energy sector that promises not only a generous yield but also a commendable growth in dividends. With a forward dividend yield of 6.64%, this stock ranks in the top 20% of high-yield dividends, significantly surpassing the industry average of 4.3%. However, as with all high-yield investments, it’s wise to be wary of potential dividend traps.

What’s more impressive is the stock’s 3-year Dividend Compound Annual Growth Rate (CAGR) of 14%, also placing it in the upper echelon of dividend stocks. This indicates a consistent and aggressive growth in payouts, reflecting the company’s robust financial health and commitment to returning value to shareholders.

Additionally, since making it to this portfolio back in May 2023, the stock has managed to consistently beat the benchmark.

Mark your calendars! The next anticipated payout is around the corner, with an estimated $0.268 per share on or around January 9. This upcoming distribution is not just a testament to the stock’s reliability but also a timely opportunity for investors seeking to enhance their income streams.

The selection of this stock is driven by a meticulous strategy, optimizing for Yield Attractiveness and Dividend Safety while balancing Returns Potential and Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 6, 2023.

Dive deeper into our in-depth stock analysis to understand the metrics that make this mid-cap energy sector stock a worthy contender in the realm of high dividend investments.