In the dynamic landscape of high dividend investing, a certain mid-cap eREIT stands out, now a proud addition to the prestigious Best High Dividend Stocks model portfolio. This move marks a significant step for dividend investors seeking stable yet lucrative investment avenues.

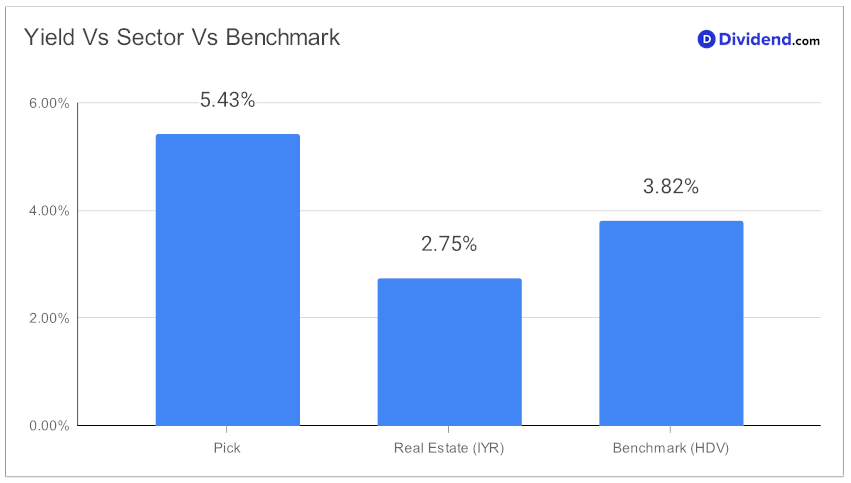

With a forward dividend yield of 5.43%, this eREIT not only surpasses many of its peers but also aligns closely with the industry average of 5.5%. It’s crucial for investors to navigate cautiously around potential dividend traps, making this eREIT’s performance all the more impressive.

A testament to its consistency and reliability is its 30+ year track record of dividend increases, positioning it in the elite top 10% of dividend stocks. This remarkable history, coupled with a 10% 3-year dividend/share compound annual growth rate, places the eREIT in a favorable position in the top 40% of dividend stocks.

Attention should also be drawn to its upcoming payout. Investors can anticipate an unchanged, non-qualified dividend of $0.565 per share, going ex-dividend next Tuesday, January 30. This timely payout underscores the eREIT’s commitment to shareholder returns and financial stability.

This inclusion in the model portfolio follows a rigorous recommendation process prioritizing Yield Attractiveness and Dividend Safety, with a balanced consideration of Returns Potential and Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 2, 2023.

As we delve deeper into the nuances of this investment opportunity, our in-depth analysis will explore how this eREIT fits into the broader narrative of high-yield investing and what it could mean for your portfolio.