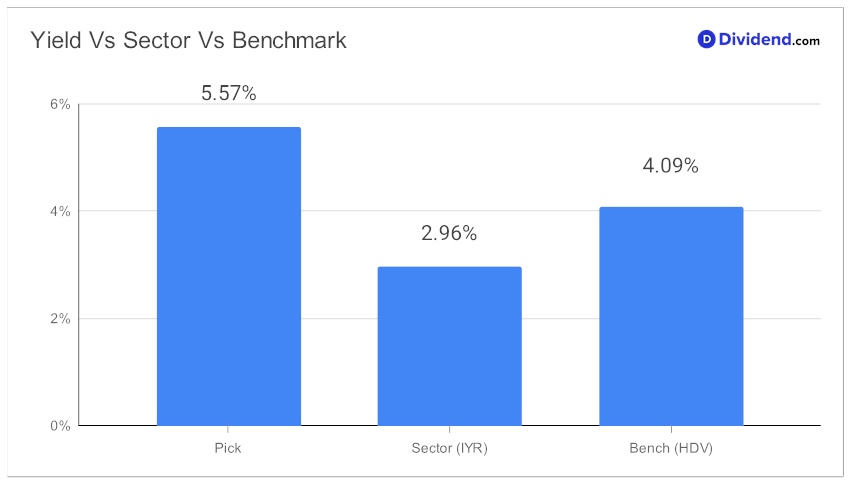

Looking for a robust addition to your high-dividend stock portfolio? A well-covered large-cap eREIT (equity Real Estate Investment Trust) has recently been added to our Best High Dividend Stocks model portfolio, and for good reason. With a forward dividend yield of 5.57%, this investment opportunity ranks in the top 20% of dividend stocks, narrowly trailing the eREIT industry average of 5.7%.

Having said that, it is important to note that like many in the real estate sector, the stock has faced downward pressure primarily due to concerns surrounding the commercial real estate segment. The company’s stock price reflects this trend, showing a decline of 13% year-to-date compared to S&P 500’s 17% gain.

However, the company has adopted a specific focus that could make its business model more resilient. By targeting single-unit commercial properties and engaging in long-term net lease agreements with high-quality clients, it aims to secure a stable and robust revenue stream. This strategic approach has served the company well so far, with the REIT managing to stand out from the rest of the pack for its remarkable 30-year track record of dividend increases. In fact, it sits in the top 10% of dividend stocks.

In terms of risk mitigation, this stock boasts a beta of 0.79, indicating that its monthly returns are generally not correlated with the broader equity markets. This feature can serve as an attractive diversification tool for your existing equity portfolio.

You can expect the next payout as an unchanged non-qualified dividend of $0.256 per share, having gone ex-dividend on August 31 and scheduled for a September 15 pay date.

We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 3, 2023.

Ready for the details? Stay tuned for our comprehensive stock analysis that delves deeper into this high-yield opportunity optimized for yield attractiveness and dividend safety, and to a lesser extent, returns potential and returns risk.