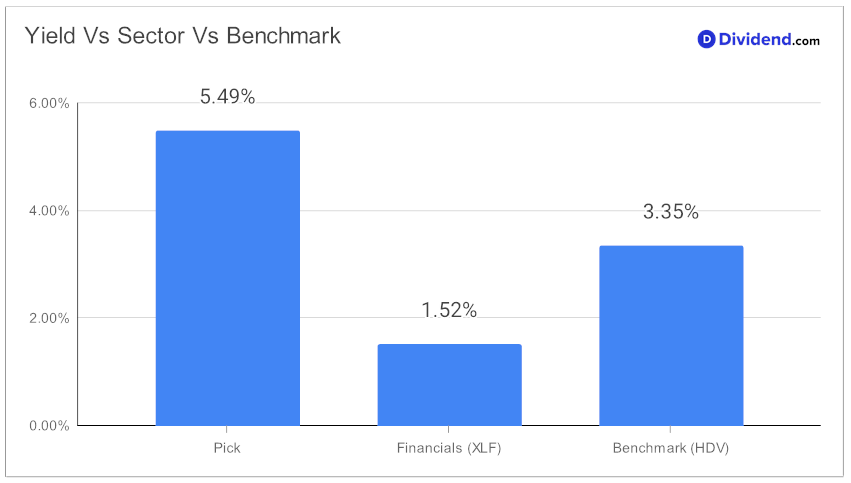

In the realm of high dividend stocks, a well-covered mid-cap asset management stock has caught the attention of seasoned investors seeking reliable income streams. With a forward dividend yield of 5.49%, this stock stands out, not only surpassing the industry average of 4.3% but also marking itself as a superior choice within the top 40% of dividend stocks. Such yield reflects not just an attractive income potential but also a testament to its financial robustness, underscored by a sustainable payout ratio of 42%—closely aligning with the asset management industry’s norm.

Investors will find an additional layer of appeal with the upcoming dividend payment, anticipated to be around $0.200 per share on or about April 25. This schedule underscores the stock’s consistent commitment to returning value to shareholders.

While arriving at the recommendation we also factored in the 1Q24 earnings call discussion by the company management held on 24 Apr, 2024. The asset management firm reported assets under management rising to nearly $1.7 trillion, driven by robust net long-term inflows and favorable market conditions. Despite a challenging economic environment marked by fluctuations in U.S. equity markets and fixed income sectors, the firm demonstrated strong growth in its Exchange-Traded Funds and global liquidity products.

Management projects an effective tax rate of 23% to 25% for the upcoming quarter and has taken significant steps to strengthen its balance sheet, including a major debt redemption. The board approved an increase in the quarterly dividend, emphasizing a commitment to returning value to shareholders amidst ongoing economic uncertainties.

For those looking to deepen their investment strategies, a comprehensive analysis follows, offering insights into the stock’s yield attractiveness, dividend safety, and an assessment of both return potentials and associated risks. This balanced approach ensures that investors are not just chasing high yields but are also cognizant of the underlying financial health and market position of their investments.