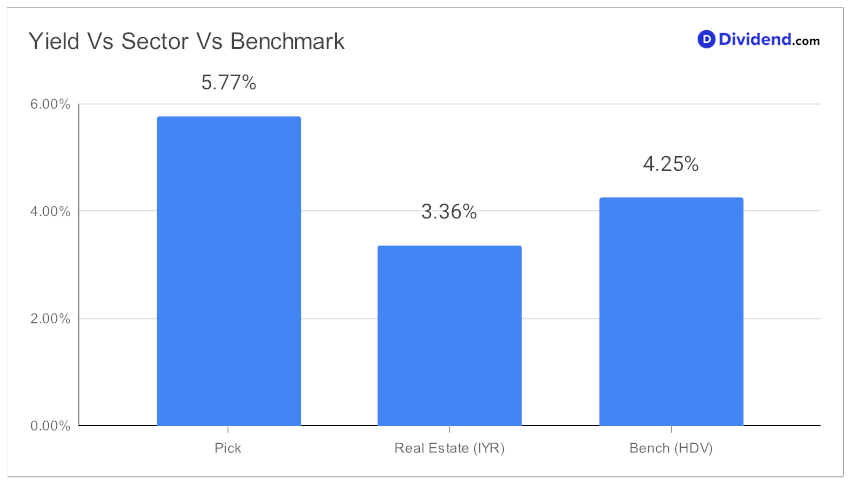

In the landscape of high-yield investments, a new champion emerges, seamlessly fitting into the elite cadre of the Best High Dividend Stocks model portfolio. With a robust 5.77% forward dividend yield that eclipses the expectations of the most discerning high dividend investors, this well-covered large-cap eREIT stands out—not just for its yield, which impressively ranks in the top quintile of its peers but also for its strategic blend of dividend safety and growth potential.

While the industry averages a 6.1% yield, our latest addition avoids the dreaded dividend traps that often ensnare the unwary. The next distribution looms on the horizon, with an estimated $0.415 per share slated to enrich shareholders on or around December 8th—an event not to be missed.

In the face of challenging conditions within the commercial real estate (CRE) landscape leading several U.S. banks to reduce their exposure to this industry, there remain specific niches within the real estate sector that are worthy of investor consideration.

Our most recent pick exemplifies such an industry, standing out as one of the most prominent proprietors of gaming facilities across the United States. This REIT’s strategy of possessing a varied array of gaming establishments, hospitality venues, dining outlets, and assorted entertainment locales—and then leasing them back to operators under long-term net leases ensures a dependable stream of rental revenue. This approach not only enables the REIT to distribute a comparably generous dividend but also to reserve capital for ongoing investment opportunities.

Revisiting our thorough recommendation process, it extends beyond just the appeal of high yields. Our approach carefully assesses the robustness of the dividend’s safety while delicately weighing the prospects for return against the accompanying risks. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 26, 2023.

The in-depth analysis that follows this teaser will unfurl the layers of this eREIT’s performance and strategy, offering a detailed roadmap to why it’s been hailed as a prime pick for those seeking to optimize their portfolio’s income stream.