For those on the quest for high dividend yields, a particular large-cap Energy Master Limited Partnership (MLP) may just be your next go-to. This firm boasts a forward dividend yield of 7.38%, landing it in the top 20% of all dividend stocks and clearly setting it apart as a high-yield option. This aligns with the Energy MLP industry average yield of 7.8%.

However, the allure doesn’t stop at the yield. This stock is a dividend investor’s dream with a remarkable 26-year track record of dividend increases. This consistency puts it in the upper echelon, within the top 10% of all dividend-paying stocks. What’s more, future increases are expected to continue.

The company continues to benefit from one of the strongest financial profiles within the energy MLP industry and given the healthy crude oil prices, improved drilling activity, and cost efficiencies, the company management expects crude oil production to increase going forward. This is reflected in the stock’s year-to-date performance, wherein the stock returned nearly 13%, almost matching the S&P 500’s return and outperforming the Energy MLP industry average of 8%. This suggests that the stock not only offers an attractive yield but also holds its own in terms of capital appreciation.

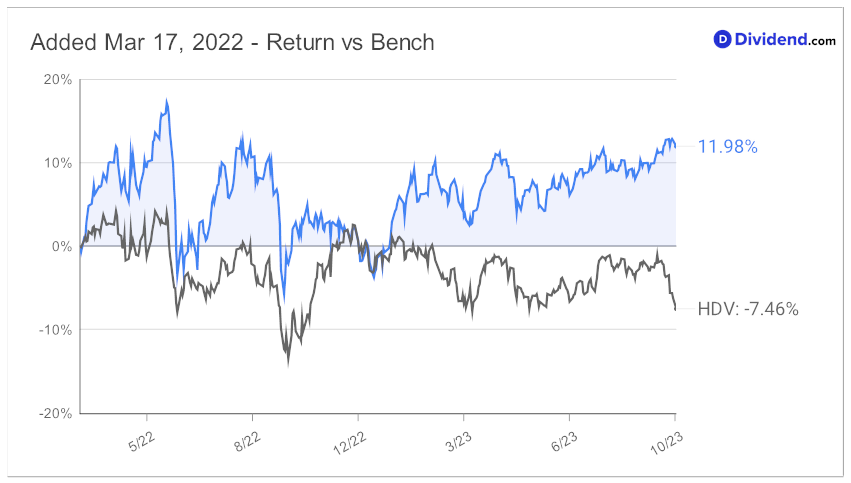

Additionally, the stock has been consistently ahead of this portfolio’s benchmark since making it to the list back in March 2022.

Investors should mark their calendars for the next anticipated payout, which is estimated at $0.500 per share sometime soon.

While high yields can often be dividend traps, this stock has been chosen for its Yield Attractiveness and Dividend Safety. Returns Potential and Returns Risk have been considered to a lesser extent in the recommendation process. We also take into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 1, 2023.

For a deeper dive into why this stock might be the right addition to your dividend-focused portfolio, stay tuned for the in-depth analysis that follows.