For high dividend investors seeking robust opportunities, a particular large-cap eREIT stands out in the Best High Dividend Stocks model portfolio. This stock demonstrates a formidable performance in the realm of yield attractiveness and dividend safety, making it a compelling choice for discerning investors.

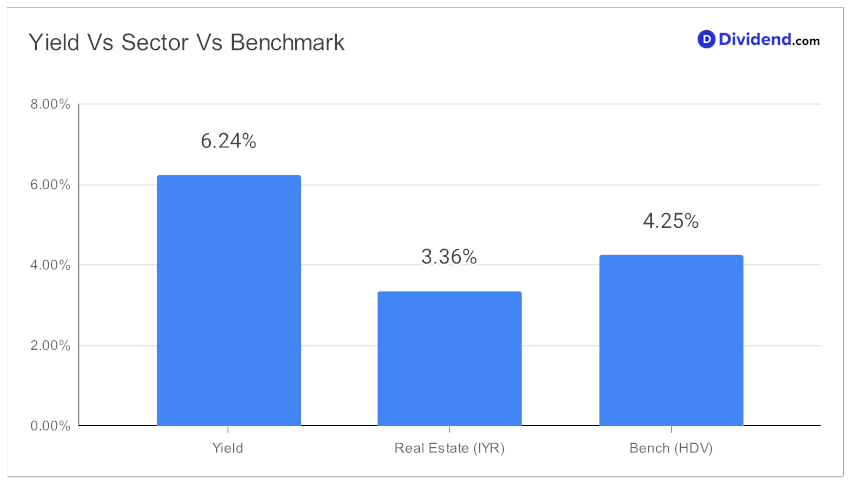

One of its most striking features is its forward dividend yield of 6.24%, placing it in the top echelon of dividend stocks. This yield not only surpasses the eREIT industry average of 6.0% but also flags the stock as a high yield option. However, investors should stay vigilant about potential dividend traps, a common pitfall in high yield scenarios.

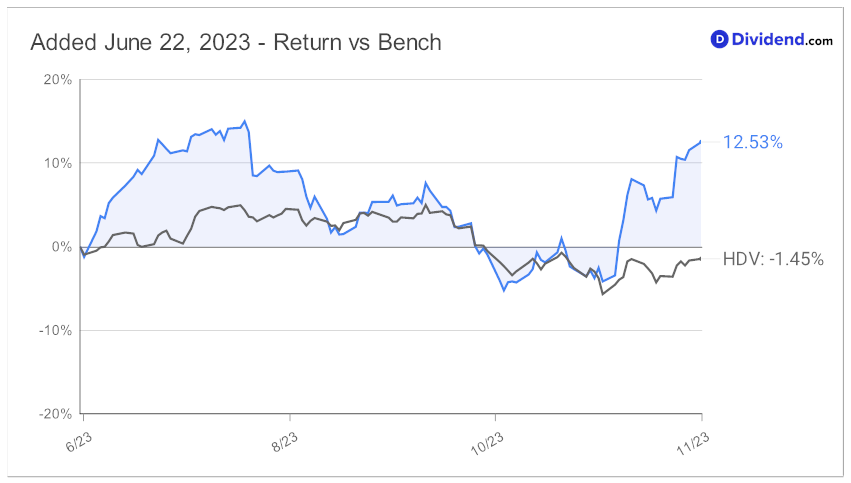

Year-to-date, the stock has showcased a commendable return of 10%, which, though trailing behind the S&P 500’s 19% return, surpasses the 3% return of the eREIT industry. Additionally, since making it to this portfolio back in June 2023, the stock has comfortably outperformed the portfolio benchmark. This performance highlights its resilience and potential as a valuable addition to a dividend-focused portfolio.

Investors should particularly note the next payout: a steadfast, unchanged non-qualified dividend of $1.900 per share, scheduled to go ex-dividend on December 7. This consistency in payouts is a reassuring sign of the stock’s stability and reliability as a dividend source.

In an environment marked by escalating interest rates and the evolving landscape of e-commerce, our pick has skillfully charted its course through these turbulent waters. A key factor in its success is its strategic partnerships with top-tier retailers, combined with a keen focus on mixed-use development properties. These properties have soared in popularity recently, as they blend residential, commercial, and retail spaces, offering people the convenience of living, working, and shopping in one integrated location.

As the holiday season approaches, the company is well-positioned with a significant lineup of retail leases, setting the stage for heightened demand across its diverse property portfolio. Moreover, the firm’s capacity to maintain financial agility underscored by its robust investment-grade credit ratings, acts like a cherry on top, further enhancing the company’s strong outlook.

The in-depth stock analysis that follows delves deeper into this investment opportunity, exploring its potential for yield attractiveness, dividend safety, returns potential, and returns risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on October 30, 2023.

This comprehensive analysis aims to provide investors with a clear understanding of the stock’s position in the high dividend landscape, aiding in making informed investment decisions.