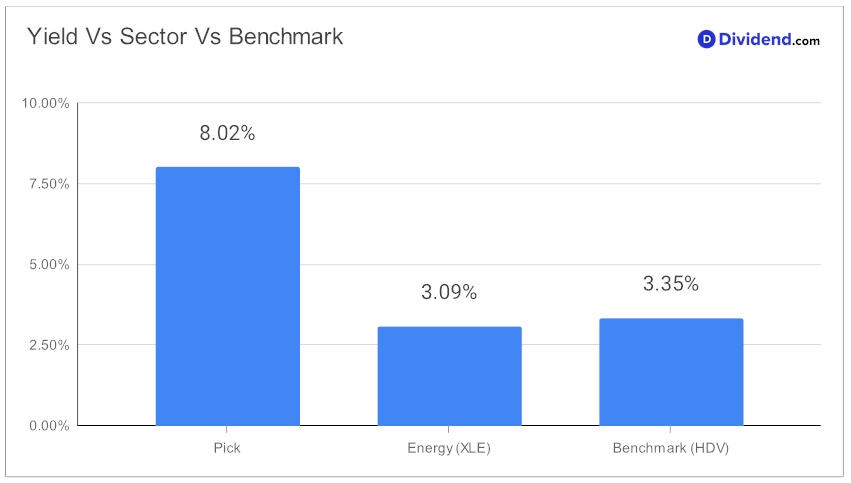

In the realm of high dividend stocks, discerning investors are continually on the lookout for robust opportunities that blend yield attractiveness with dividend safety. Amidst this search, a well-covered large-cap Energy Master Limited Partnership (MLP) stands out, reaffirming its position in the esteemed Best High Dividend Stocks model portfolio. This entity distinguishes itself with an 8.02% forward dividend yield, placing it in the top echelon of dividend stocks, significantly outpacing the industry average of 6.0%. Such a yield is not just a number but a testament to its financial strength and commitment to shareholder returns.

Furthermore, the company boasts a prudent 40% forward payout ratio, aligning closely with the industry’s norm and ensuring sustainability. Impressively, its 3-year dividend compound annual growth rate (CAGR) of 27% ranks it among the best, reflecting a robust growth trajectory. Year-to-date, it has outperformed, delivering a 17% return, eclipsing both the S&P 500 and its industry peers. Additionally, since making it to this portfolio back in July 2023, the stock has consistantly surpassed this portfolio’s benchmark.

Investors keen on the next payout can look forward to an estimated $0.315 per share on or around April 26, highlighting the tangible rewards of holding such a promising stock.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 15 Feb, 2024. The energy infrastructure company reported record financial and operational performance in 2023, reflecting robust growth and strategic expansion. The company saw a 5% increase in adjusted earnings before interest, tax, depreciation and amortization (EBITDA), with significant contributions from operational records and recent acquisitions. Management highlighted the impact of rising global demand for natural gas liquids (NGL) on the company’s growth.

Looking ahead, the company anticipates continued operational stability and growth, with capital expenditures projected to enhance infrastructure and environmental initiatives. The company announced an increase in quarterly cash distribution, underscoring a commitment to delivering shareholder returns amidst a positive financial outlook and strategic positioning to meet global energy demands.

This brief glimpse into the company’s financial health and shareholder return profile serves as a precursor to an in-depth analysis that examines its yield attractiveness, dividend safety, and potential returns, offering a comprehensive view for high dividend investors.