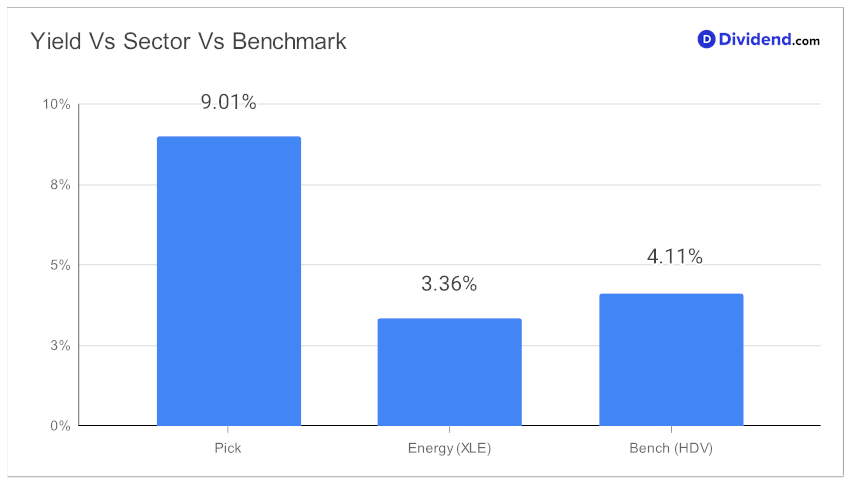

If you’re on the hunt for high-yielding dividend stocks, you might want to pay close attention to this well-positioned, large-cap Energy Master Limited Partnership. Standing out with a forward dividend yield of 9.01%, this stock doesn’t just beat the Energy MLP industry average of 7.4%—it even lands in the top 20% of all dividend-paying stocks. But it’s not just about yield; it’s about safety too. With a forward payout ratio of only 37%, it finds itself well below the industry average of 44%, offering a cushion for sustained payouts.

When it comes to returns, this stock is equally impressive. Year-to-date, it has outperformed, delivering a 16% return compared to the S&P 500’s 14% and the Energy MLP industry’s 11%.

Ability to generate high, yet stable, cash flows based on a diversified energy midstream business continues to help the company. This also helps it maintain an investment-grade rating for its debt. With organic expansion projects and acquisitions fuelling growth forward, the stock has been able to beat this portfolio’s benchmark by a significant margin since making it to the portfolio back on July 4, 2023.

The next estimated payout of $0.310 per share is just around the corner, expected on or about October 25.

The recommendation process involved optimizing for two key metrics: Yield Attractiveness and Dividend Safety, and to a lesser extent, Returns Potential and Returns Risk. We have also taken into account the growth drivers and financial results discussed by the company management during their Q2 2023 earnings call held on August 2, 2023.

Stay tuned for an in-depth stock analysis that delves into all these factors to give you a comprehensive view of this high-dividend holding.