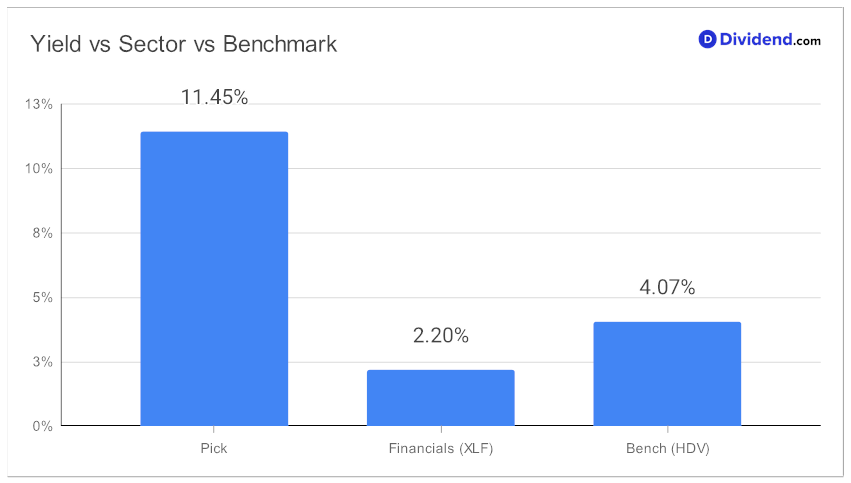

Looking to enrich your high dividend portfolio? Get ready to delve into the riveting world of a small-cap Business Development Company (BDC) boasting a formidable 11.45% forward dividend yield. This yield lands it firmly in the top 20% of dividend stocks, a well-deserved recognition in a sector averaging 11.6%.

With a solid 7-year track record of dividend increases, this enigmatic entity positions itself among the top 30% of dividend stocks, revealing promising prospects for future increments. Clocking a 9% 3-year dividend per share Compound Annual Growth Rate (CAGR), it enters the top 40% league of all dividend stocks. Despite a year-to-date return of 10%, somewhat trailing the S&P 500’s 14%, it surpasses the 8% average for its industry. Additionally, since being added to the portfolio back in February 2023, it has managed to beat the benchmark and limit losses.

Ready for some immediate returns? A special qualified payout of $0.050 per share is scheduled for June 30th.

Stay tuned for an in-depth stock analysis to follow, guiding your investment choices by optimizing yield attractiveness, dividend safety, return potential, and risk.