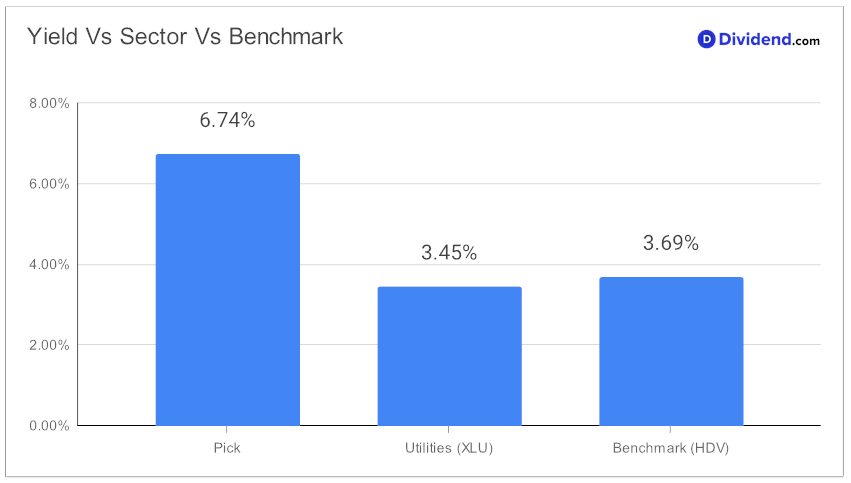

In the ever-evolving quest for financial growth and stability, high dividend investors are continually on the lookout for promising opportunities that stand out in the crowded market. A noteworthy addition to the esteemed Best High Dividend Stocks model portfolio emerges as a well-covered mid-cap in the Utilities sector, offering a forward dividend yield of 6.74%. This figure not only places it in the top 20% of dividend stocks but also showcases its high yield status, a significant consideration for those vigilant about dividend traps. Despite the industry average yield being slightly higher at 7.6%, the company’s forward payout ratio of 16%—aligned with the sector’s average—underscores a robust financial foundation promising sustainability and growth.

Investors should mark their calendars for the upcoming payout estimated at $0.396 per share on or around May 3, reflecting a tangible return on investment in the near term.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 22 Feb, 2024. The renewable energy focused utility company reported its financial outcomes, navigating through fluctuations in renewable resource availability to meet its projected financial benchmarks for 2023. Despite industry-wide challenges, particularly reduced wind resources, the firm maintained its financial resilience with strategic investments in renewable projects and a diversified energy portfolio. The company announced a 1.7% dividend increase for 2024 and projected a significant uplift in its Cash Available for Distribution (CAFD).

With a forward-looking strategy aiming for a substantial CAFD per share by 2026, the firm underlined its commitment to sustainable growth and shareholder value enhancement, leveraging long-term contracts and strategic investments across wind, solar, and storage sectors.

This selection, grounded in a meticulous optimization for Yield Attractiveness and Dividend Safety, along with a balanced consideration for Returns Potential and Risk, signifies a compelling case for inclusion in one’s investment portfolio. The subsequent in-depth analysis will delve deeper into the metrics that underscore this opportunity, offering investors a comprehensive overview to inform their decision-making process.