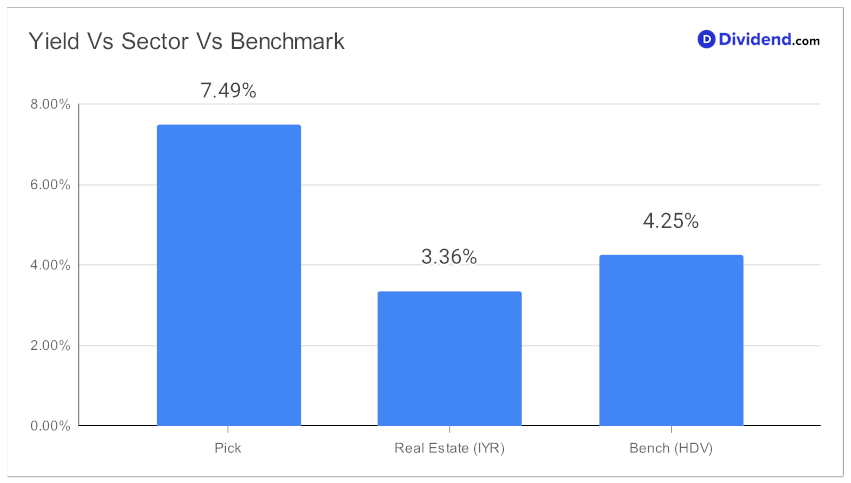

Attention high dividend investors! Are you on the lookout for a standout addition to your portfolio? We’ve just introduced a mid-cap eREIT into our Best High Dividend Stocks model portfolio, and it’s a game-changer. This thinly-covered gem is turning heads with its remarkable 7.49% forward dividend yield, placing it in the top 20% echelon of high-yield dividend stocks. But beware the allure of dividend traps; this yield outshines the eREIT industry average of 5.9%, promising more than just attractive numbers.

The stock’s dividend growth is equally impressive, boasting a 21% 3-year dividend per share compound annual growth rate (CAGR), again ranking in the top 20% across all dividend stocks. The commitment to rewarding investors doesn’t end there. Brace yourselves for the next payout – a notable 1.8% increase to a non-qualified $0.285 per share, going ex-dividend on December 28.

It is interesting to note that in a challenging operating environment marked by high interest rates, the REIT is wisely reducing its portfolio size. Facing increased acquisition costs, it is also avoiding the pursuit of overpriced assets. The REIT’s current strategy mainly involves selling assets that are likely to achieve favorable valuations in the current market. The intention is to accumulate funds from these sales, creating a reserve for acquiring properties when market conditions offer more advantageous pricing points.

Our recommendation process prioritizes Yield Attractiveness and Dividend Safety, without sidelining the potential for Returns and managing Returns Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 4, 2023.

Stay tuned for an in-depth stock analysis that further explores this enticing opportunity. The perfect blend of high yield and growth potential might just be a click away.