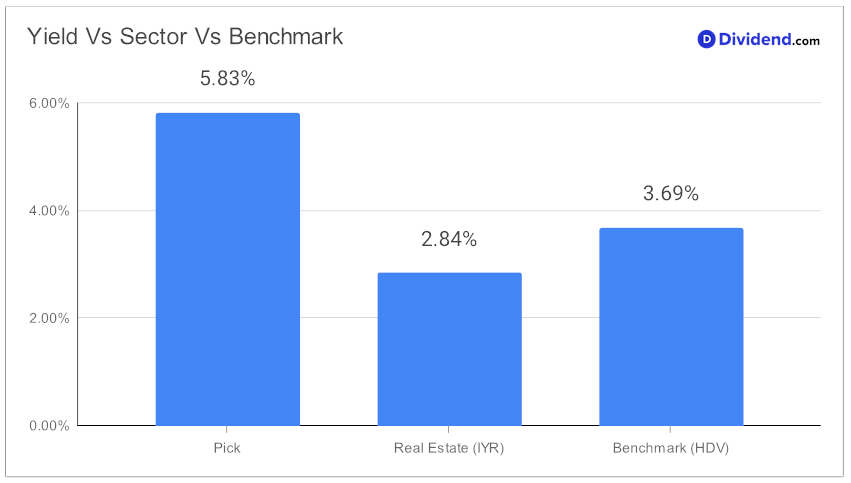

In the ever-evolving landscape of investment, discerning monthly dividend investors are always on the lookout for robust opportunities that not only promise attractive yields but also demonstrate a strong history of dividend growth. One such standout is a well-established large-cap equity real estate investment trust (eREIT), distinguishing itself with a forward dividend yield of 5.83% — placing it in the elite top 20% of its peers and comfortably above the industry average of 5.7%. This remarkable yield is underpinned by a commendable nearly 30-year streak of dividend increases, signaling not just stability but a confident outlook for future growth.

As we edge closer to April 11th, anticipation builds for the next anticipated payout, estimated at $0.257 per share. This event offers a prime moment for investors to assess the blend of yield attractiveness and dividend safety that this eREIT represents.

While arriving at the recommendation we also factored in the 4Q23 earnings call discussion by the company management held on 21 Feb, 2024. The eREIT reported a landmark year with expansive property investments and strategic expansions, driven by a global investment strategy that culminated in an historic high in property investment volume, reaching nearly $10 billion across multiple countries. This growth is reflective of its strategic market diversification, achieving a notable cash yield. The company’s ventures into new sectors and significant partnerships underscore its market adaptability and strength. Financially, it announced a positive adjusted funds from operations (AFFO) per share, with projections indicating further growth.

Management emphasized strategic financial planning, enabling substantial investment goals without additional public equity sales, highlighting disciplined capital deployment aimed at attractive returns. The firm’s robust financial structure and prudent risk management strategies, including significant bond issuances, support its operations amidst capital market fluctuations. The outlook remains optimistic, with a focus on continued strategic growth and shareholder returns, signaling a strong foundation for future success in the commercial real estate market.

Our in-depth analysis dives deeper into these facets, evaluating the eREIT’s positioning within the broader context of the market and its adherence to a refined recommendation process that prioritizes yield attractiveness, dividend safety, and to a lesser extent, returns potential and risk among monthly payers.