In the dynamic world of monthly dividend investing, discerning investors are constantly on the lookout for opportunities that offer a blend of attractive yields, dividend growth, and stable returns. One such investment, a mid-cap eREIT, has recently been reaffirmed as a holding in the prestigious Best Monthly Dividend Stocks model portfolio.

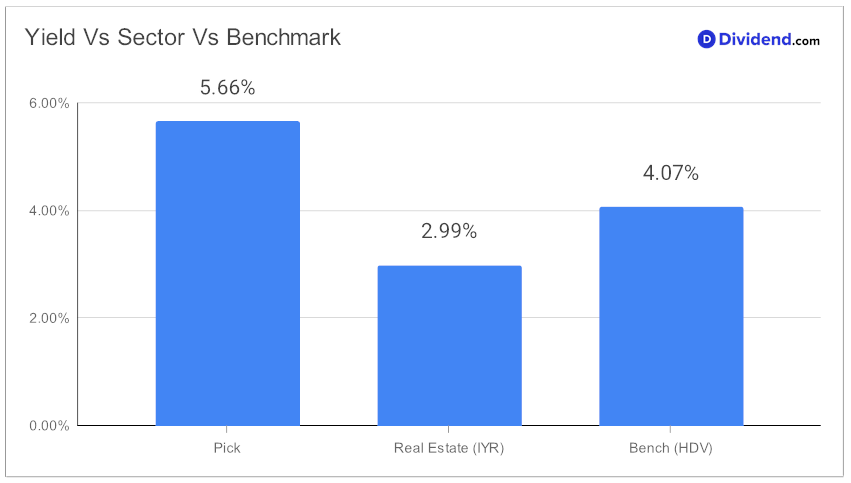

This eREIT stands out with a forward dividend yield of 5.66%, eclipsing the industry average of 5.3% and ranking in the top 20% of high-yield dividend stocks. However, it’s not just the yield that makes this investment appealing; its three-year dividend per share compound annual growth rate (CAGR) of 43% places it amongst the elite in dividend growth.

Year-to-date, this eREIT has returned an impressive 14%, showcasing its resilience and potential in a challenging market where it outperforms the industry average and closely trails the S&P 500. Since being added to this portfolio back on March 2023, the stock has also managed to outpace the benchmark.

The next anticipated payout, estimated at $0.080 per share, is expected around February 21, providing a timely benefit to shareholders.

This article teases an in-depth analysis of this eREIT, where we delve deeper into its attributes. The recommendation process focuses on Yield Attractiveness and Dividend Safety, with a nuanced consideration of Returns Potential and Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 9, 2023.

For monthly dividend investors seeking a balanced and robust portfolio, this eREIT represents a strategic choice, combining the lure of high yields with the assurance of dividend growth and stability. Stay tuned for a comprehensive stock analysis that will guide your investment decisions.

Introduction

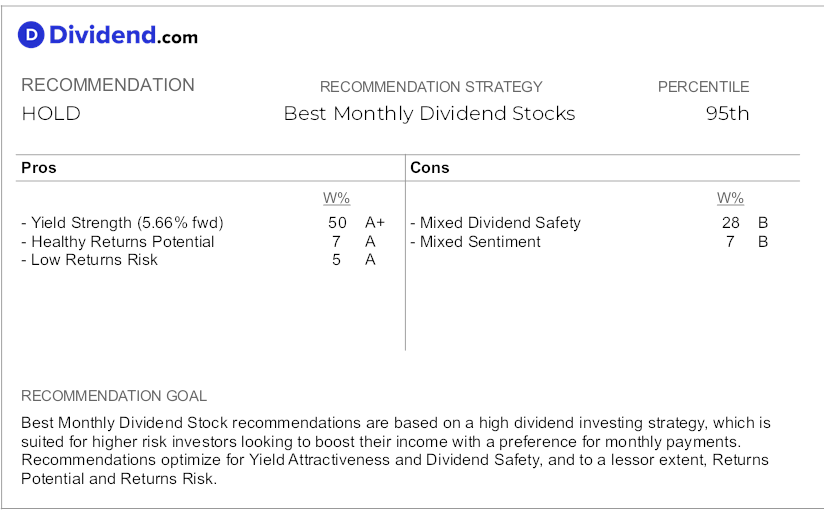

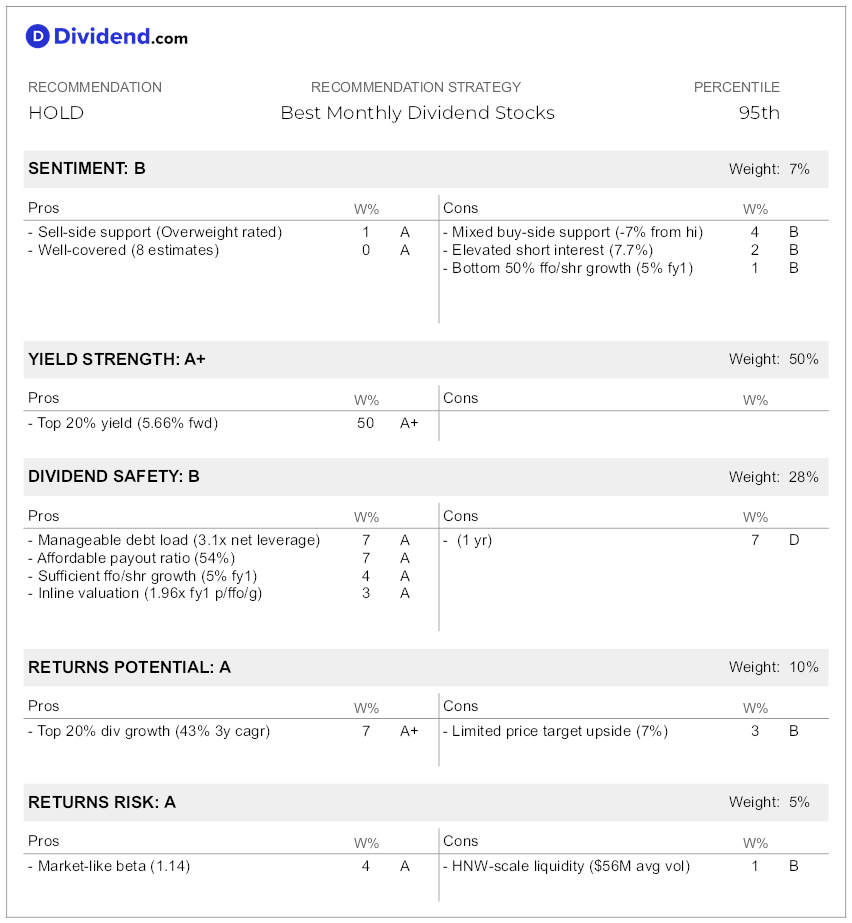

Apple Hospitality REIT Inc (APLE), a leading real estate investment trust (REIT) with a vast portfolio of upscale, rooms-focused hotels across the United States, has been reaffirmed as a holding in the Best Monthly Dividend Stocks model portfolio. This recommendation is based on a comprehensive analysis that optimizes for Yield Attractiveness and Dividend Safety, while also considering Returns Potential and Returns Risk. This article provides a detailed analysis of APLE ’s performance, growth drivers, market sentiment, dividend profile, and returns profile, offering valuable insights for high dividend investors seeking to maximize their monthly dividends.

The table below summarizes the overall factors and corresponding weights used in our recommendation:

Company Profile

Description

Apple Hospitality REIT, Inc. (NYSE: APLE) is a publicly traded real estate investment trust (REIT) that owns one of the largest portfolios of upscale, rooms-focused hotels in the United States.

The company’s portfolio consists of 223 hotels with over 29,400 guest rooms located in 87 markets across 37 states. The hotels are primarily Marriott, Hilton, and Hyatt-branded.

It is a self-advised company that invests in income-producing real estate, primarily in the lodging sector. It was founded by Glade M. Knight on November 8, 2007, and is headquartered in Richmond, VA.

It derives its income from hotel revenue, its sole segment.

Growth Drivers

In the company’s earnings call, CEO Justin G. Knight reported strong quarterly performance with significant growth in Revenue per Available Room (RevPAR), occupancy, and Average Daily Rate (ADR) since the pandemic, underpinned by robust leisure and business travel demand.

Knight, pleased with the results, highlighted the strongest quarterly RevPAR growth since the pandemic began, outperforming Q3 2019 by 7%. This was accompanied by increased occupancy and ADR, leading to improved EBITDA figures. The upward trend continued with an optimistic projection for the year’s end, driven by positive occupancy and ADR trends. The company’s strategic approach of diversifying into high-quality, rooms-focused hotels with low financial leverage has been effective, as demonstrated by the recent acquisition of four hotels, with three more pending, and a strategic expansion into markets like Salt Lake City and Renton.

Elizabeth S. Perkins, the company’s Senior Vice President & Chief Financial Officer, reinforced the positive outlook with detailed financials. The company experienced a 4% revenue rise for the quarter and a 9% increase over nine months, topping $1 billion. There was also a 3% rise in comparable hotel RevPAR, a 1% increase in ADR to $159, and a 2% growth in occupancy to 77%. The leisure segment exhibited robust performance with high weekend occupancy, and business travel demonstrated strengthened demand with increased weekday occupancy. Stability in room night channel mix was noted, with a small rise in Online Travel Agency bookings and a decrease in Global Distribution System bookings.

The company has managed costs effectively, evidenced by a reduction in contract labor costs, despite overall cost pressures from higher wages and labor usage, which are expected to moderate. Adjusted EBITDA for hotels showed a modest increase, with strong margins even though there was a minor decline compared to the previous year. The balance sheet remained strong, with low net debt relative to EBITDA and a solid liquidity position.

Looking ahead, the company’s acquisitions were strategically funded to maintain a healthy debt-to-EBITDA ratio. Projections for the year were adjusted, with RevPAR and EBITDA expectations refined, indicating net income projections and controlled capital expenditures. Perkins concluded with confidence in the company’s resilience, competitive market position, and liquidity, anticipating performance above the midpoint of their guidance amidst uncertain macroeconomic conditions.

Market & Analyst Sentiment

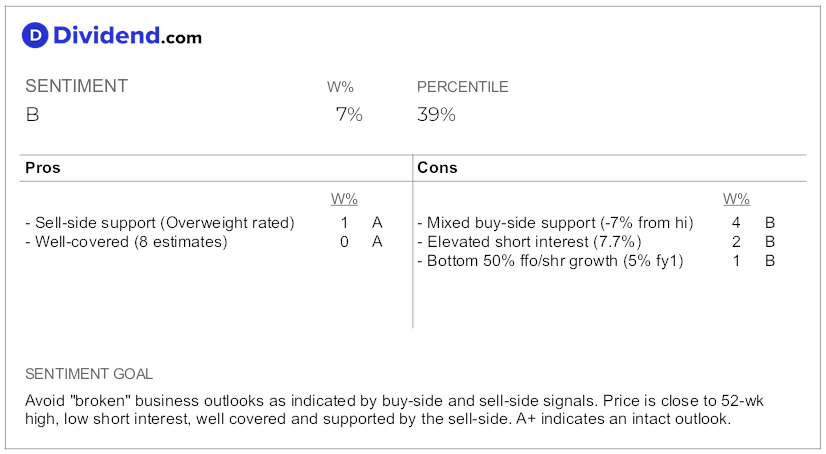

The market sentiment for Apple Hospitality REIT Inc (APLE) is mixed. Despite having a market cap of $4.0B and being part of the real estate sector, the stock has seen both support and opposition from the sell-side and buy-side, with a notable 7.7% short interest. Analysts, on average, have an Overweight rating on the stock, anticipating a modest 5% growth in funds from operations per share (ffo/shr) next year. However, the stock is currently underperforming relative to its 52-week highs, trailing the S&P 500 by -6% versus -1%. Despite this, it is performing on par with other eREITs, which as a group are down by -9%. This suggests that while there are some concerns, there is also a level of optimism for future growth.

Formulas:

- -7% % from 52-wk hi = $16.96 share price / $18.22 52-week high price – 1.

- 7.7% short interest = 16.4M shares short / 213.1M float shares.

- 8 analyst estimates = number of sell-side analysts providing estimates for the stock.

- Overweight analyst rating = average rating from 8 sell-side analysts.

- 5% fy1 ffo/shr growth = $1.83 fy1 ffo/shr / $1.75 fy0 ffo/shr – 1.

Dividend Profile

Yield Attractiveness

The Yield Attractiveness was graded A+ due to the high forward dividend yield of 5.66%, which ranks in the top 20% of dividend stocks, making it a high yield investment. This is higher than the eREIT industry average of 5.3%, indicating a more attractive return on investment. However, investors are cautioned to be wary of potential dividend traps. The annual dividend is $0.960 per share, which is distributed on a monthly basis, making it a consistent source of income for investors. The next payout is estimated to be $0.080 per share, scheduled for distribution on or around February 21.

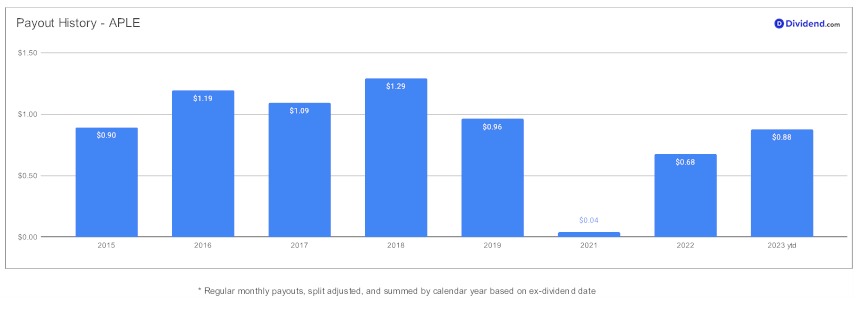

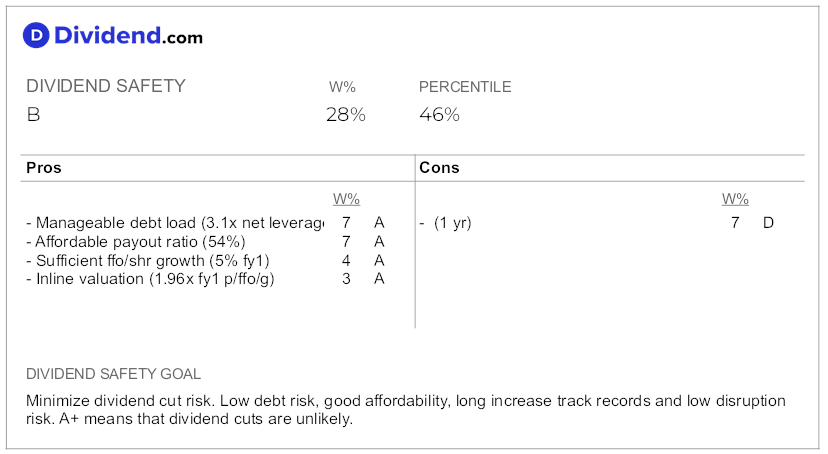

Dividend Safety

The Dividend Safety grade for APLE is B due to a combination of factors. The dividend is supported by a reasonable 54% payout ratio, which is slightly below the eREIT average of 56%. The company’s debt load is manageable with a net leverage of 3.1x, which, while elevated, poses a low risk. The company is expected to see a stable 5% growth in ffo/shr in the next fiscal year. The valuation of 1.96x p/ffo/g is slightly lower but generally in line with the eREIT average of 2.36×. However, the company only has a 1-year track record of increasing dividends, which contributes to the mixed assessment of its dividend safety.

Formulas:

- 5.66% forward yield = $0.96 annualized dps / $16.96 share price.

- 1 yr of increases = Consecutive years of dividend increases.

- 3.1x leverage = ($1.5B debt – $72.8M cash) / $450.4M ntm ebitda.

- 54% payout ratio = $0.96 annualized dps / $1.79 ntm ffo/shr.

- 5% fy1 ffo/shr growth = $1.83 fy1 ffo/shr / $1.75 fy0 ffo/shr – 1.

- 1.96x p/ffo/g = 9.25x fy1 p/ffo / 4.7% run-rate ffo/shr growth.

Returns Profile

Returns Potential

The Returns Potential of APLE was graded as ‘A’ based on two main factors: the 3-year dividend Compound Annual Growth Rate (CAGR) and the analyst price target upside.

The 3-year dividend CAGR of APLE is 43%, which ranks in the top 20% of all dividend stocks. This indicates that the company has been consistently increasing its dividends over the past three years at a high rate, which is a positive sign for investors looking for regular income from their investments. This strong dividend growth contributes to the high Returns Potential grade.

However, the analyst price target upside of 7% is relatively low. This suggests that sell-side analysts believe the stock is nearing its fair market value, implying limited potential for significant price appreciation in the near future. This could be a concern for investors seeking capital gains from their investments, as the potential for stock price growth appears to be limited.

Despite this caveat, the strong dividend growth appears to have outweighed the limited price target upside in the grading of APLE ‘s Returns Potential, resulting in a grade of ’A’. This suggests that the returns potential of APLE is considered to be healthy overall, although investors should be aware of the limited potential for price appreciation.

Formulas:

- 43% 3y dividend CAGR = (CY0 dps / CY-3 dps)^(1/3) – 1.

- 7% price-target upside = $18.14 average price target / $16.96 share price – 1.

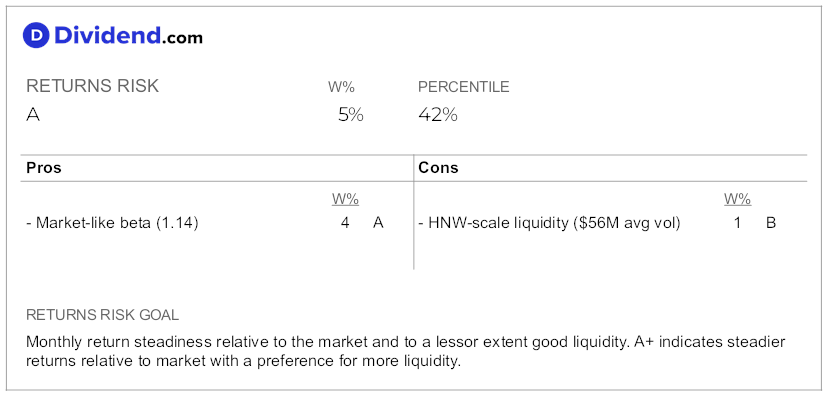

Returns Risk

The Returns Risk was graded as ‘A’ because APLE ’s returns risk is considered low. However, there are some factors to consider. The beta of 1.14 indicates that the monthly returns are similar in direction and magnitude to the equity markets, which suggests a market-like risk. Additionally, the moderate liquidity, with a $56M daily trading volume, is suitable for holdings up to $14M in size assuming a 1-day exit and 25% utilization. This could potentially limit the size of investments that can be quickly liquidated without impacting the market price.

Formulas:

- 1.14 beta = correlation of monthly price changes over the last 5 years.

- $56M daily liquidity = 3.3M daily shares traded on average over the last 10 days * $16.96 share price.

Quant Recommendation

The recommendation for Apple Hospitality REIT Inc (APLE) is to hold. This recommendation is based on the company’s yield attractiveness and dividend safety, as well as its potential and risk for returns. Despite its attractive 5.66% yield, APLE ’s monthly dividend rank has been lowered due to mixed dividend safety. There are 61 other stocks that offer a better combination of monthly dividend factors. Only the top 10% of these stocks receive buy recommendations.

The table below shows the detailed factors and corresponding weights used in our recommendation:

Conclusion

Apple Hospitality REIT Inc (APLE) has been reaffirmed as a holding in the Best Monthly Dividend Stocks model portfolio. The company’s strong performance, including significant growth in Revenue per Available Room (RevPAR), occupancy, and Average Daily Rate (ADR), has been driven by robust leisure and business travel demand. Despite some market concerns, there is optimism for future growth, supported by a high forward dividend yield of 5.66% and a 3-year dividend Compound Annual Growth Rate (CAGR) of 43%. However, investors should be aware of the limited potential for price appreciation and the mixed assessment of its dividend safety.

Do you want more monthly dividend ideas? Follow the holdings in our Best Monthly Dividend Stocks model portfolio, which we review each week.

Disclosure

The author nor anyone on our investment team personally owns the stock mentioned in this investment analysis. This analysis and its results are based solely on the research provided by Dividend.com.