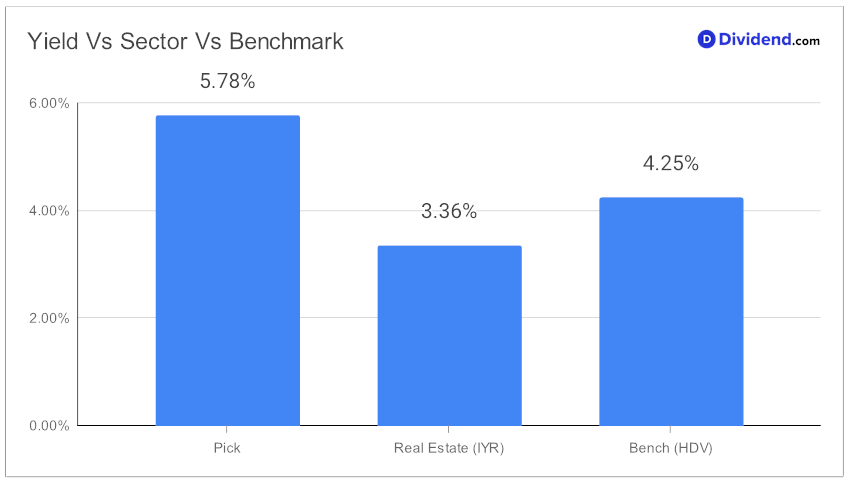

In the ever-evolving landscape of monthly dividend investing, there emerges a standout performer that reaffirms its position in the Best Monthly Dividend Stocks model portfolio. This well-covered mid-cap eREIT, shining with a forward dividend yield of 5.78%, not only surpasses industry averages but also positions itself in the high-yield category’s top echelon. Investors should note, however, the importance of vigilance against potential dividend traps, a common pitfall in high-yield scenarios.

Remarkably, this eREIT showcases a 43% 3-year dividend/share compound annual growth rate (CAGR), landing it in the upper 20% of all dividend stocks. In a year-to-date comparison, it has outperformed the eREIT industry average with an 11% return, though it trails behind the S&P 500’s 20% surge.

Today, investors keenly anticipate the next payout phase—an unchanged non-qualified $0.080/share, marking a critical juncture for those tracking monthly income streams. This payment milestone is a crucial element in our comprehensive analysis, where we delve deeper into the nuances of Yield Attractiveness, Dividend Safety, and the intricate balance between Returns Potential and Risk. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 9, 2023.

Stay tuned for an in-depth exploration of this eREIT’s investment profile, a guidepost for those navigating the monthly dividend investment realm.