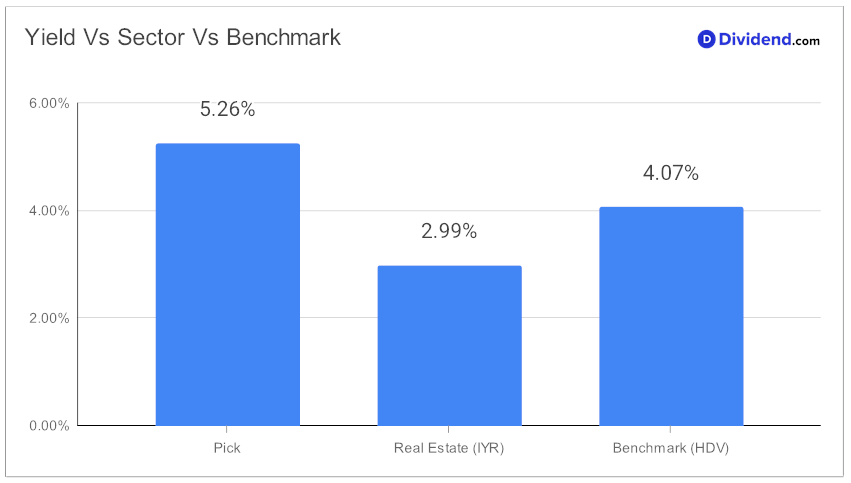

As savvy monthly dividend investors seek stable, high-yielding opportunities, one standout performer consistently emerges, boasting a robust 5.26% forward dividend yield that outshines the eREIT industry average. With an impressive 30+ year streak of dividend increases and a reputation for dividend safety, this large-cap eREIT represents a prime holding for those optimizing for Yield Attractiveness and Dividend Safety. While its year-to-date return mirrors the broader eREIT industry, its commitment to growth and shareholder returns remains unshaken.

The next payout is not just another dividend; it’s a testament to the company’s enduring promise, offering a 0.2% increase to a non-qualified $0.257 per share. This recent increment, which went ex-div on December 29 with a January 12 pay date, underscores the company’s dedication to rewarding its investors.

Dive into our in-depth analysis to understand how this monthly dividend stock stands out in a crowded market, offering a blend of reliability and attractive returns in a complex investment landscape. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 8, 2023.