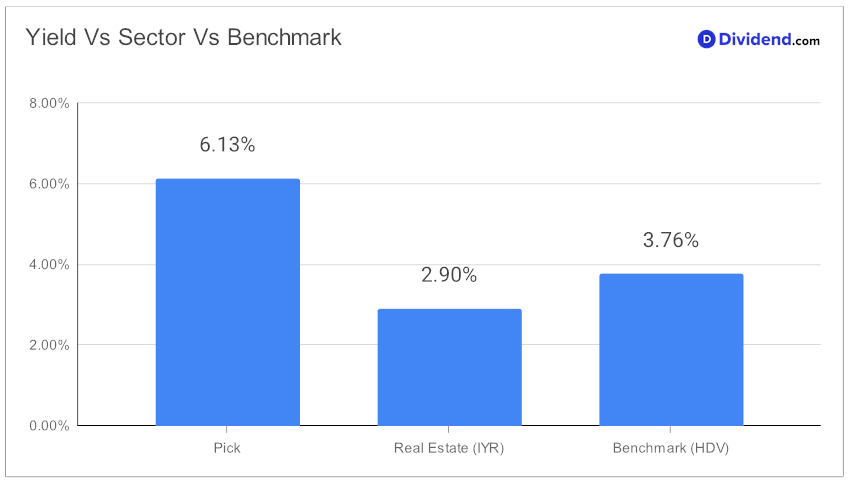

In the ever-evolving landscape of investment, one asset has reaffirmed its position as a cornerstone in the portfolios of those seeking monthly dividends. This well-covered mid-cap equity REIT stands out for its impressive yield, which, at 6.13%, not only surpasses the industry average of 5.8% but also ranks it within the top 20% of high-yield dividend stocks. However, investors are advised to navigate this high-yield terrain with caution, mindful of potential dividend traps. What sets this entity apart is its staggering three-year dividend growth rate (CAGR) of 188%, placing it among the elite in dividend growth.

As monthly dividend investors look towards their next payout, they can expect an unchanged distribution of $0.080 per share, which became effective at the end of January, with payments being disbursed mid-February. This stability in payouts is a testament to the REIT’s financial health and operational efficiency.

Our analysis delves deeper into the criteria of Yield Attractiveness and Dividend Safety, with a balanced consideration for Returns Potential and Risk among monthly payers. While arriving at our recommendation, we’ve also factored in the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on November 9, 2023.

This comprehensive approach ensures that investors are not just chasing yields but are making informed decisions based on a holistic view of the asset’s performance and potential.