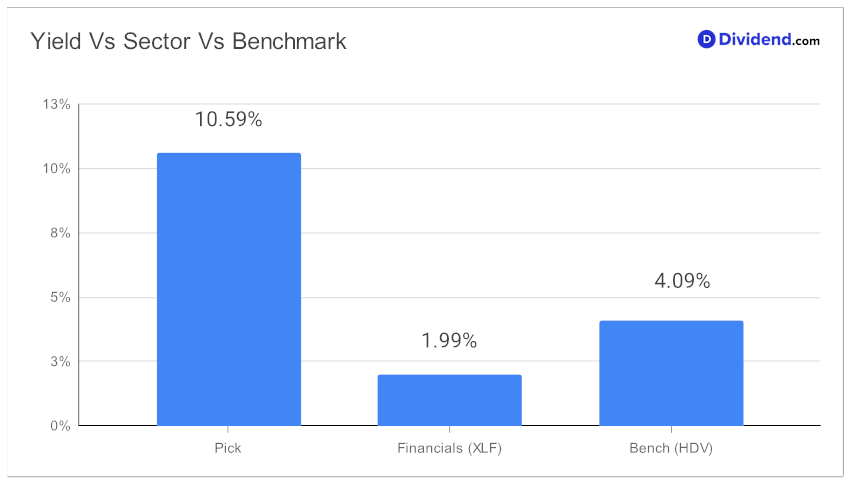

For those intrigued by the monthly dividend investment landscape, a certain small-cap Business Development Company (BDC) stands out as a compelling consideration. With a forward dividend yield of 10.59%, it not only surpasses the average yield of the broader market but also places within the top 20% of high-yielding dividend stocks. This could be particularly appealing for investors looking to optimize for yield attractiveness and dividend safety. However, caution is advised to avoid potential dividend traps, especially when the industry average yield for BDCs stands at 11.1%.

In 2022, small-cap firms were hit hard by record inflation, rising interest rates, and recession fears. But easing inflation, fewer rate hikes and resilient economic data are now offering relief. This benefits BDCs like ours that focus on small firms. The company continues to exercise strong underwriting standards, particularly in offering lower-risk senior secured loans. The management is optimistic about investment opportunities in the lower middle market, which includes expanding current investments. This strategy is expected to counterbalance the effect of slowing deal activities in today’s economic conditions.

Looking at immediate benefits, investors can anticipate the next monthly payout estimated at $0.083 per share, set to be disbursed on or around October 11. A monthly payout schedule can offer a more regular income stream, thereby providing additional liquidity to your investment strategy. This feature might align well for those who give secondary weightage to factors such as returns potential and returns risk, but focus predominantly on yield and safety.

This offering is part of the Best Monthly Dividend Stocks model portfolio, which rigorously evaluates candidates based on multiple financial metrics. We have also taken into account the growth drivers and financial results discussed by the company management during their Q3 2023 earnings call held on July 27, 2023.

For an in-depth stock analysis and detailed insights on this BDC’s position within the portfolio, stay tuned for the comprehensive article that follows.